The Current Status Quo Problem

Let’s talk about the elephant in the room – the current status quo problem in risk management.

We’ve all been there, drowning in manual steps, grappling with unstructured data, and trying to make sense of disparate solutions.

The problem? Lengthy approval processes, inconsistent decision-making, and excess risk loss ratios.

It’s time to break free from this cycle and usher in a new era of streamlined operations.

Enter Worth AI’s Singular Platform.

Breaking Down the Quagmire

Manual tasks, the bane of every risk officer’s existence, often lead to delays and bottlenecks. Unstructured data creates a chaotic landscape where extracting meaningful insights is akin to finding a needle in a haystack.

Disparate solutions add to the complexity, making it challenging to maintain consistency in decision-making.

It’s time to disrupt this status quo and embrace a solution that brings order to the chaos.

Introducing Worth’s Singular Platform

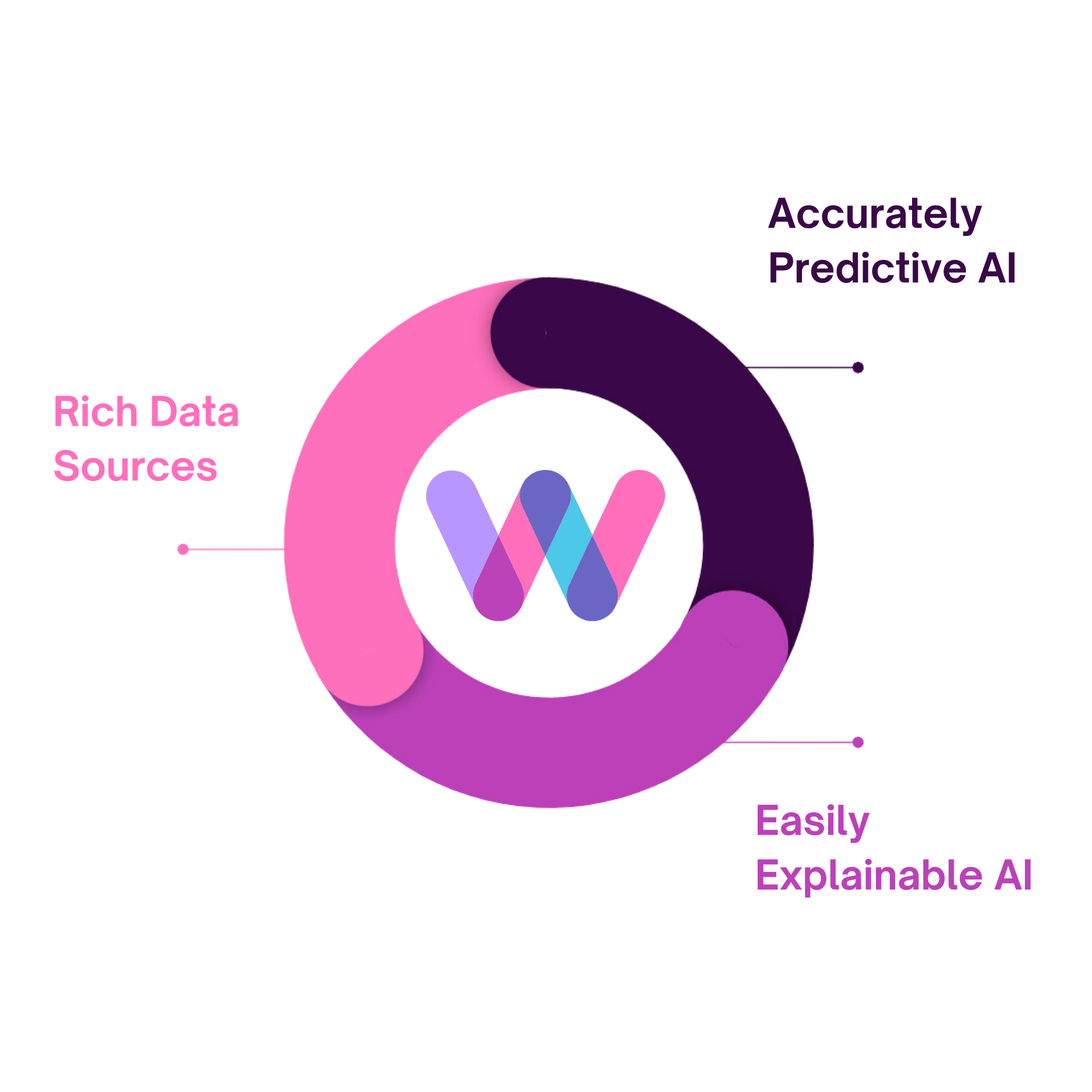

Imagine a world where you have a consolidated platform for AI-powered underwriting and onboarding activities. That’s what Worth AI brings to the table.

The Singular Platform is designed to eliminate manual tasks, provide continuous risk monitoring, and ensure consistent decision-making.

Chief Risk Officer Decisioning

Gain visibility into your portfolio like never before.

Worth’s platform allows you to drive actionable results in managing your portfolio by continuously monitoring and flagging risk scenarios. Understand the total potential risk, identify growth opportunities, and drill down to understand the origination of risks.

It’s decision-making made easy.

Onboarding Acceleration

Time is money, especially in the world of risk management. With Worth AI’s onboarding acceleration, powered by global intelligence, you can expedite credit decisions.

This facilitates faster customer onboarding, enabling businesses to acquire capital quickly for rapid growth.

Say goodbye to sluggish processes and hello to agility.

Accurate and Efficient Underwriting

Worth’s advanced decision-making engine analyzes thousands of data points, ensuring precise and efficient case management.

The result?

Increased loan approval rates and access to vital funds for businesses. It’s about making the right decisions at the right time.

Predictive Risk Monitoring

Gone are the days of reactive risk management. Worth AI’s platform provides ongoing portfolio evaluation, offering businesses instantaneous status updates and predictive monitoring capabilities.

This proactive approach allows businesses to address potential risks promptly, mitigating losses before they occur.

Worth Score™️: Redefining Creditworthiness

At the heart of the Worth AI platform lies Worth Score™️, a predictive business value score synchronizing financial information to generate comprehensive business credit scores.

This addresses the persistent issue of low loan approval rates for SMBs, enhancing creditworthiness and fostering economic equity.

Schedule a Demo and Embrace Financial Inclusion

Ready to revolutionize your approach to risk management? Schedule a demo with Worth AI now.

Witness the transformative power of AI innovation in redefining underwriting processes. Don’t miss the chance to be part of this – schedule your demo today and embrace a future of streamlined operations and economic inclusion.