Continuous Monitoring and Alerts

Move your underwriting process from static to dynamic. Replacing periodic reviews with continuous, real-time monitoring ensures that risk signals are surfaced as they happen, enabling your team to quickly identify and prevent future losses and increase loan margins.

- Enable small business customers to seamlessly link accounts and upload documentation.

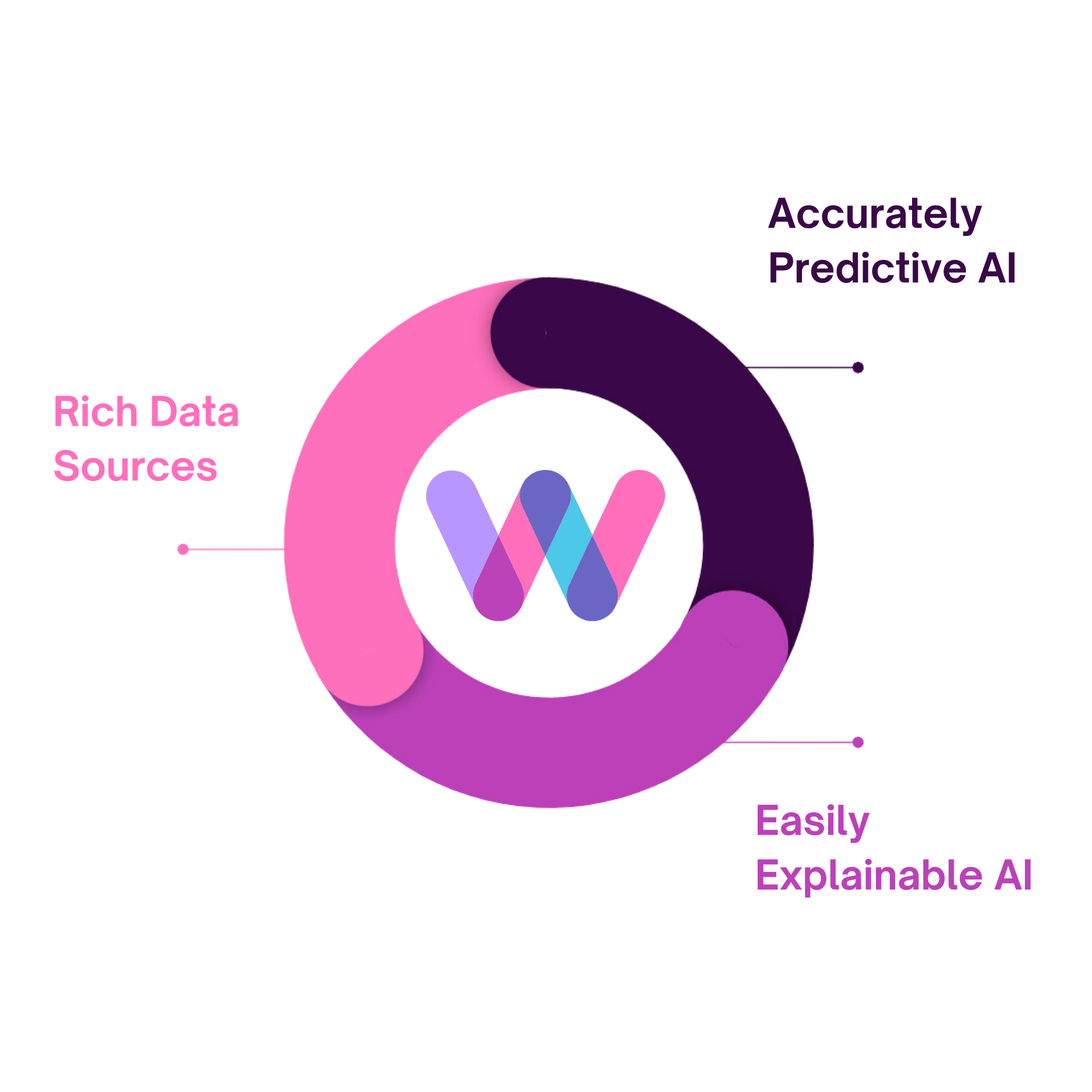

- Utilize Worth’s AI underwriter for comprehensive data verification against 1,000+ sources.

- Continuously validate small business borrowers against predefined risk profiles.

- Receive instant alerts on changes in a borrower’s credit profile to preempt defaults.

- Leverage Worth’s predictive capabilities to forecast loan portfolio health 24 months in advance.