Discover How Worth AI Revolutionizes Business Credit Risk Assessment Unlock the power of advanced AI-driven credit risk assessment with Worth. Our innovative solution combines multiple data sources and cutting-edge machine learning techniques to provide comprehensive and interpretable credit risk scores. Download our white paper to dive deeper into how our technology can transform your business. […]

Ensuring robust security and compliance during the onboarding process is paramount. At Worth, we understand that advanced Know Your Business (KYB) and Know Your Customer (KYC) protocols are critical to safeguarding your institution and your clients. Worth’s Instant Onboarding solution has revolutionized our approach, streamlining compliance and due diligence processes while enhancing overall financial security. […]

What is Section 1071? In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced Section 1071, aiming to promote fairness and transparency in small business lending. This section mandates financial institutions to collect and report detailed data on credit applications from small businesses, including information about the business and its principal owners. The […]

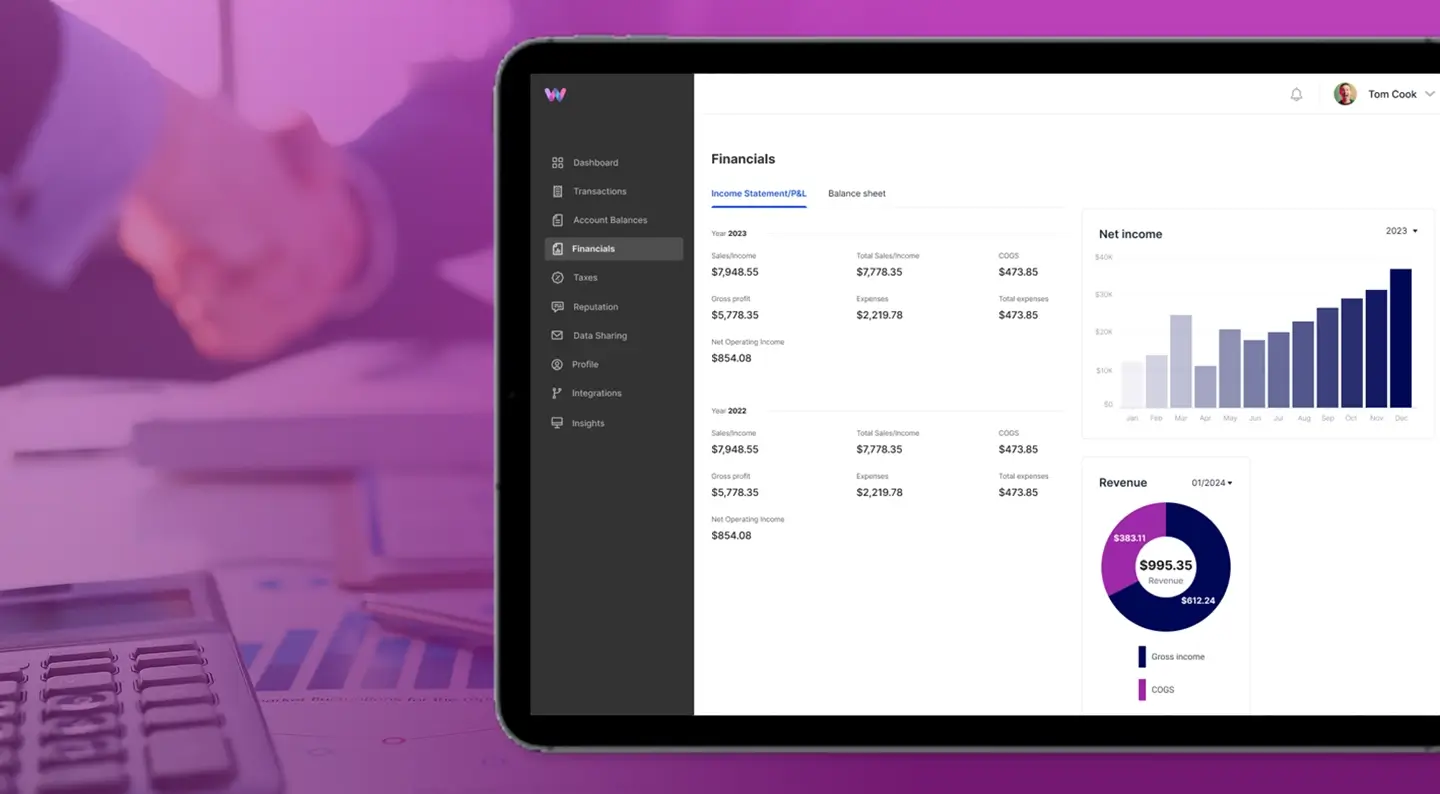

Accurately predicting credit risk is paramount to maintaining a healthy portfolio and avoiding unnecessary losses. Worth’s Automated Risk Assessment Dashboard is designed to do just that: Providing a comprehensive suite of tools that streamline risk management and enhance decision-making. Here’s how our cutting-edge technology can help you perfectly predict portfolio credit risk and protect your […]

Welcome to Worth! If you’ve ever found yourself asking, “W.T.F. is Worth?”—don’t worry, you’re not alone. In this blog, we’re breaking down Worth’s Tech Features (W.T.F.) that make us stand out in the financial technology landscape. Let’s dive in and explore what makes Worth the ultimate game-changer for financial institutions. W.T.F. is Worth? Worth is […]

In the fast-paced world of financial services, first impressions matter. For financial institutions, the onboarding process is the first significant interaction with new customers and can be a cumbersome process filled with endless paperwork, back-and-forth communications, and prolonged wait times. This is where Worth steps in: Revolutionizing the customer acquisition process with AI-powered instant onboarding. […]