Continuous Monitoring and Alerts

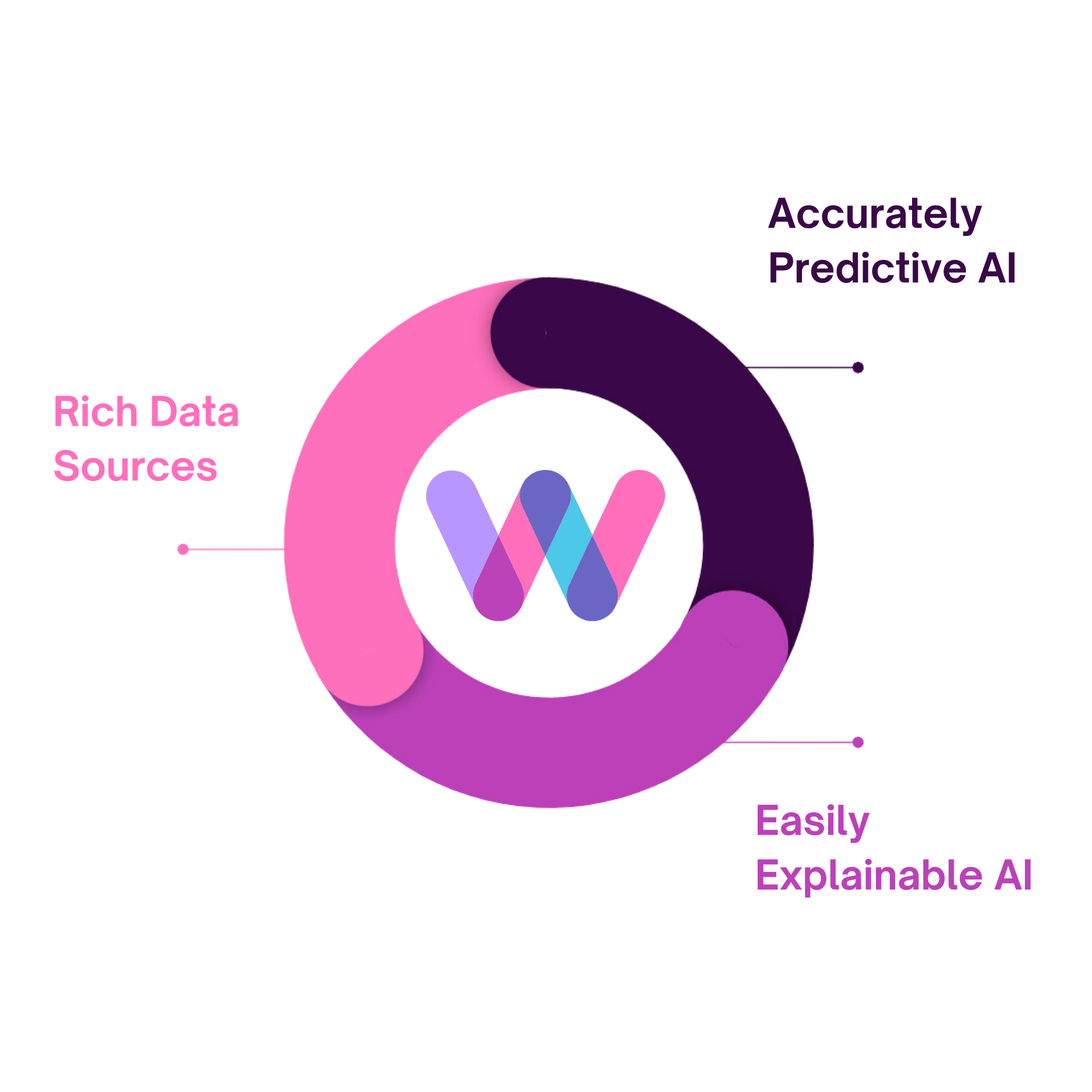

Worth AI equips your credit union to compete with tech-savvy banks and lenders. Our real-time monitoring solution ensures dynamic risk management and loan growth.

- Continuously validate small business members’ credit profiles against predefined criteria.

- Streamline member experience by eliminating reporting and documentation requests.

- Receive instant alerts on member credit profiles for preemptive risk management and upsell opportunities.

- Utilize predictive capabilities to forecast lending portfolio health up to 24 months in advance.