Most people think of Independent Sales Organizations, or ISOs, as pure sales engines. ISOs help merchants access the payment systems they need by connecting them to sponsor banks and simplifying the onboarding experience. At a high level, the ISO model has not changed much. Typically, they focus on selling and referring merchants while leaving the […]

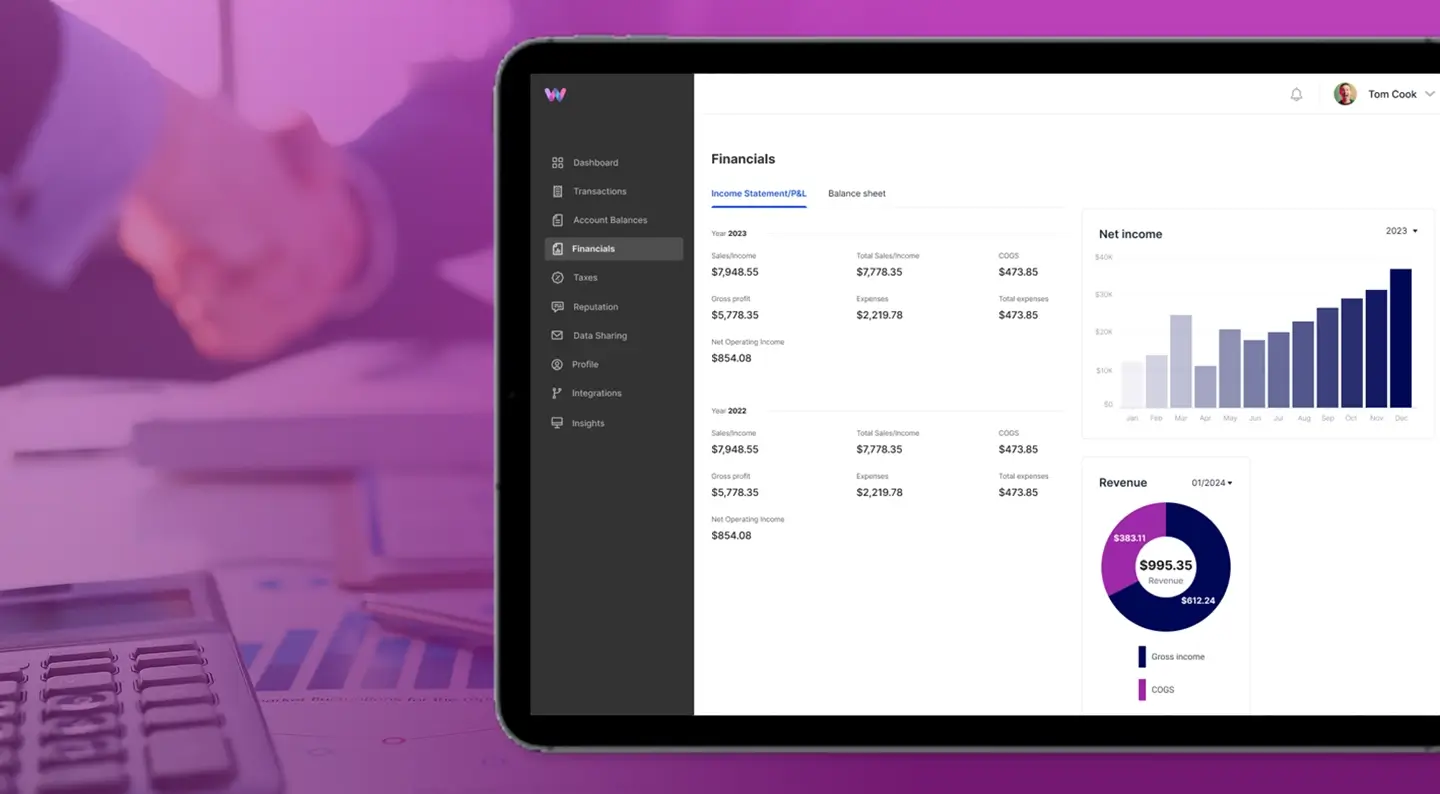

Worth has always been laser-focused on building the most reliable, intelligent platform for onboarding and underwriting in financial services. As demand for automation and AI-powered decisioning grows, so does the responsibility to support our customers with the speed, precision, and stability they expect. This year, our momentum has been unmistakable. Since securing our seed round […]

If 2023 was the year of chatbots, 2025 is shaping up to be the year of Agentic AI. But what the heck even is Agentic AI? At its core, Agentic AI is the next evolution of artificial intelligence. These are systems that do more than respond to commands. They plan tasks, make decisions, and take […]

Commerce no longer stops at the border, and neither should onboarding. The World Bank estimates there are over 400 million small and medium-sized businesses worldwide, with cross-border registrations up 28% since 2020. The opportunity is enormous. So why do financial institutions still say that international coverage for KYB is such a big operational pain point. […]

That’s a wrap on Money20/20 2025! Worth showed up focused, energized, and ready to shape the future of financial innovation. From AI-driven underwriting to collaborative ecosystems transforming compliance and risk, this year’s event embodied how the future of finance will be built on partnerships, transparency, and technology that keeps the pace of its users. What […]

At Worth, Customer Success is the bridge between our customers and our mission to simplify underwriting and onboarding for financial institutions. We sat down with Jenn, the Head of Customer Success, about how her team creates a white-glove experience for our customers: Want to see our Customer Success team in action? Get started by scheduling […]