Risk Underwriting Beyond Conventional Approaches

Imagine having a 360-degree view of a financial forecast for a small to medium-sized business, achieved within minutes. It’s a feat that has long been elusive in the financial industry. That is until Worth AI entered the scene.

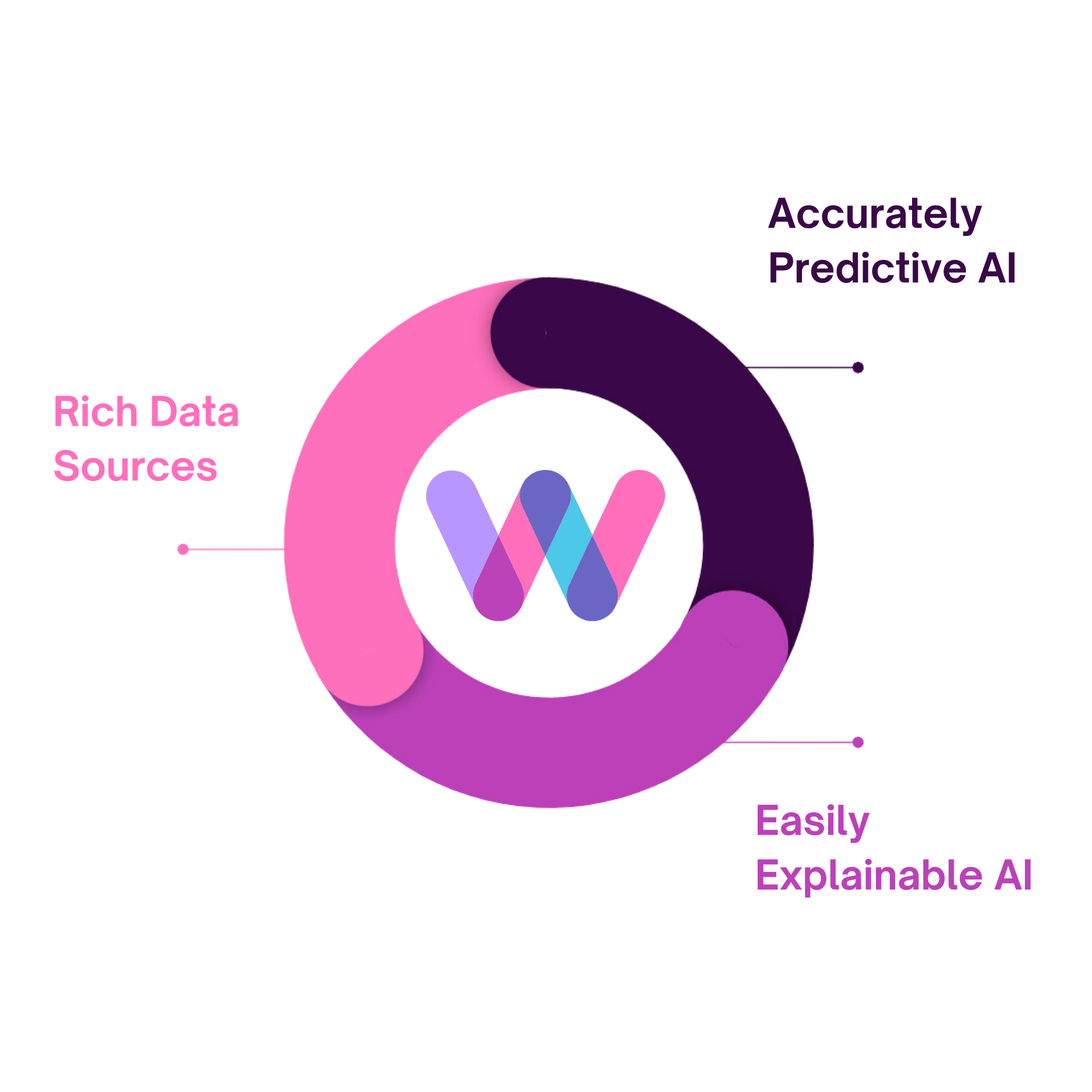

Worth AI is rewriting the rules for small business lending by leveraging a strategic partnership with Equifax that marries innovation and industry expertise.

This powerhouse duo utilizes diverse traditional and non-traditional data sources to generate the unique ‘Worth Score™️’—a comprehensive business profile available within minutes. The strategic relationship with Equifax empowers Worth AI to process an extensive volume of data, enabling AI models to operate more efficiently.

This streamlines the underwriting process and saves valuable time, allowing resources to be reallocated toward innovation and strategic decision-making.

Championing Modern Machine Learning Methods

Worth AI is not content with the status quo; it’s at the forefront of transforming small business lending by championing the adoption of modern machine learning methods.

The platform bids farewell to traditional linear models, statistical distributions, and simple decision trees in favor of advanced techniques that ensure more accurate predictions. Equifax, bringing its industry expertise to the table, contributes valuable insights into the evolving landscape and the role of these modern approaches in reshaping lending dynamics.

The relationship sets the stage for a new lending era driven by innovation and accuracy.

Building a Seamless Small Business Underwriting System

Worth AI’s commitment to revolutionizing small business lending goes beyond mere analysis. The platform emphasizes the importance of end-to-end case management for a seamless underwriting process.

From the initial assessment to the final approval, Worth AI promises a more efficient and effective approach, streamlining the lending journey.

Industry leaders are collectively reshaping the lending ecosystem by harnessing the power of AI, incorporating non-traditional data sources, embracing modern machine learning methods, and implementing end-to-end case management.

The Role of AI in Analyzing Actionable Insights

AI becomes instrumental in analyzing massive datasets and extracting meaningful information to guide strategic decision-making. The marriage of industry knowledge and cutting-edge technology is poised to redefine how risk officers approach their roles.

Robust Relationship Analysis with Non-Traditional Niche Sources

Worth AI specializes in robust relationship analysis, enriching data by incorporating non-traditional niche sources. Regulatory data, tax filings, Google reviews, and transaction data are among the diverse elements considered, creating comprehensive connections that traditional models often overlook.

This holistic approach paints a more accurate picture of a business’s financial health and potential risk factors.

The Invitation to Industry Leaders

Industry leaders are invited to schedule a personalized demo to witness Worth AI’s technology in action and explore tailored solutions for your organizations. Don’t miss the chance to be part of this transformative journey.

Schedule your demo today and join us as we redefine the future of SMB lending.