Thriving in SMB Lending: Strategies for Credit Unions in a Competitive Landscape

As leaders in financial services, we understand the importance of staying ahead of the curve in an increasingly competitive market. One area where this competition is particularly fierce is small and medium-sized business (SMB) lending. With larger banks and fintechs vying for market share, credit unions face unique challenges and opportunities in competing in this space. In this article, we’ll explore strategies for credit unions to thrive in SMB lending, with a focus on leveraging technology, including artificial intelligence (AI), to gain a competitive edge.

Understanding the Landscape

Before diving into strategies, let’s take a moment to understand the landscape of SMB lending. Small businesses are the backbone of our economy, driving innovation, job creation, and economic growth. Yet, they often face challenges accessing affordable credit, particularly from traditional lenders. This gap in access to financing presents an opportunity for credit unions to step in and serve the needs of SMBs in their communities.

Embracing Technology

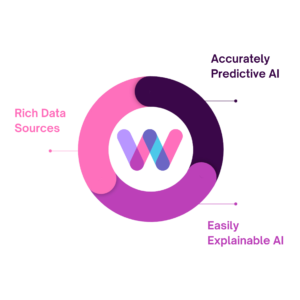

One of the key strategies for credit unions to compete in SMB lending is to embrace technology. AI, in particular, holds immense potential for transforming the lending process, from application to approval. By leveraging AI-powered tools and algorithms, credit unions can streamline lending operations, improve risk assessment, and enhance the overall customer experience.

Streamlining the Application Process

AI can be used to automate and streamline the SMB loan application process, making it faster, more efficient, and less burdensome for applicants. Chatbots and virtual assistants powered by AI can guide borrowers through the application process, answer questions in real-time, and collect necessary documentation. This not only reduces the time and effort required on the part of the borrower but also enables credit unions to process loan applications more quickly and efficiently.

Enhancing Risk Assessment

AI algorithms can analyze vast amounts of data to assess the creditworthiness of SMB loan applicants more accurately. By incorporating alternative data sources, such as cash flow data, transaction history, and social media activity, AI algorithms can provide a more holistic view of a borrower’s financial health and repayment capacity. This enables credit unions to make more informed lending decisions, reduce the risk of defaults, and offer competitive interest rates to qualified borrowers.

Personalizing the Customer Experience

Another advantage of AI in SMB lending is its ability to personalize the customer experience. By analyzing customer data and behavior, AI algorithms can identify individual preferences, anticipate needs, and tailor loan products and services to meet the unique needs of SMBs. This not only enhances customer satisfaction but also strengthens relationships between credit unions and their business members, fostering loyalty and long-term engagement.

Mitigating Compliance Risks

Compliance with regulatory requirements is a top priority for credit unions in SMB lending. AI can help mitigate compliance risks by automating regulatory reporting and monitoring processes, ensuring accuracy and consistency in compliance efforts. AI-powered tools can analyze loan portfolios for potential risks, detect anomalies or suspicious activities, and generate real-time alerts for further investigation. This enables credit unions to demonstrate compliance with regulatory requirements and maintain the trust and confidence of regulators and stakeholders.

Building Strategic Partnerships

In addition to leveraging technology, credit unions can gain a competitive edge in SMB lending by building strategic partnerships with fintechs, community organizations, and other industry stakeholders. These partnerships can provide access to innovative technologies, new markets, and expertise that can help credit unions expand their lending capabilities and reach underserved segments of the SMB market.

Competing in SMB lending requires credit unions to embrace technology and innovation to meet the evolving needs of small businesses. By leveraging AI-powered tools and algorithms to streamline the application process, enhance risk assessment, personalize the customer experience, and mitigate compliance risks, credit unions can gain a competitive edge in the SMB lending market. Additionally, building strategic partnerships with fintechs and other industry stakeholders can help credit unions expand their lending capabilities and reach new markets. With the right strategies and a commitment to innovation, credit unions can thrive in SMB lending and make a meaningful impact on the success of small businesses in their communities.