Enhancing Financial Security: Advanced Onboarding with KYB/KYC Compliance and Due Diligence

Ensuring robust security and compliance during the onboarding process is paramount. At Worth, we understand that advanced Know Your Business (KYB) and Know Your Customer (KYC) protocols are critical to safeguarding your institution and your clients. Worth’s Instant Onboarding solution has revolutionized our approach, streamlining compliance and due diligence processes while enhancing overall financial security.

All-In-One Business Verification Solution

Worth’s advanced onboarding integrates KYB, KYC, Identity Verification (IDV), and Anti-Money Laundering (AML) tools into a single, streamlined process. This all-in-one solution reduces approval times and boosts efficiency, ensuring that compliance is thorough and swift. By consolidating these verification tools, we enhance business security and build trust with our clients.

Consolidate Verification Tools

Ensuring compliance with KYB and KYC regulations is essential for maintaining business integrity. Worth’s detailed checks consolidate all necessary verification tools, enhancing your security and trustworthiness. This consolidation simplifies the process and ensures that all regulatory requirements are met, reducing the risk of non-compliance.

Automate Routine Approvals

Speed and efficiency are critical in the financial sector. Worth provides instant access to data on over 242 million businesses, which is double the size of our nearest competitors. This extensive database allows us to automate routine approvals quickly, significantly cutting down the time required for onboarding.

Comprehensive Due Diligence

Thorough due diligence is a cornerstone of secure financial operations. Worth enables us to conduct comprehensive due diligence using Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) processes. This ensures that you have an in-depth understanding of your business partners, identifying potential risks before they become issues.

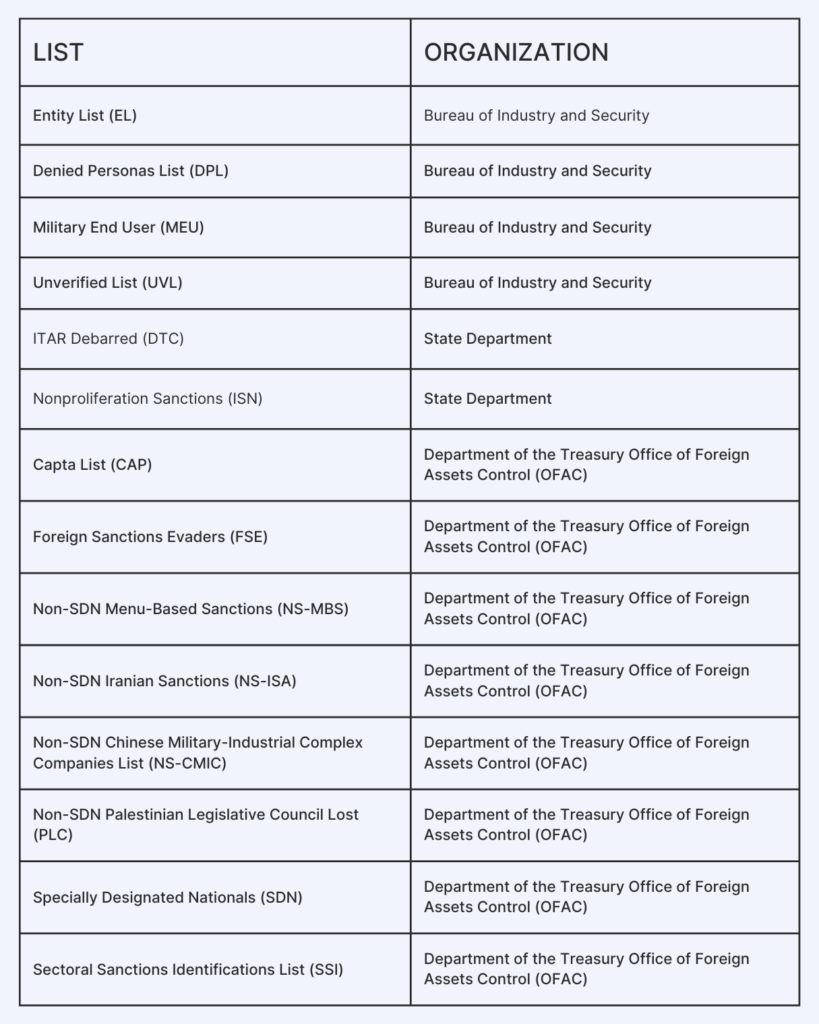

Support for US Federal Watchlists and Sanctions

Today, we support US federal watchlists and sanctions, adding an extra layer of protection and compliance. Our platform continuously scans and cross-references against these watchlists, ensuring that your institution adheres to all regulatory requirements. This proactive approach helps to identify and mitigate potential risks early, protecting your business from exposure to sanctioned entities.

KYB/KYC Checks

Worth’s KYB and KYC checks ensure comprehensive regulatory compliance, multi-source data verification, and enhanced business security. These checks are vital for maintaining the integrity of our client base.

Due Diligence Processes

Our due diligence processes include detailed CDD and EDD, partner risk assessments, and strict regulatory adherence. This thorough approach helps you to mitigate risks and make informed decisions.

Identity Verification

Worth’s multi-source identity verification prevents fraud and improves compliance. By verifying identities from multiple sources, you can ensure that your clients are who they say they are, further enhancing our security measures.

Enhancing Financial Security

Worth’s advanced onboarding solution has revolutionized our approach to KYB/KYC compliance and due diligence. By integrating comprehensive verification tools and automating routine approvals, we can enhance efficiency and security. Continuous due diligence processes ensure that we maintain a deep understanding of our business partners, safeguarding your institution from potential risks.

Enhancing financial security is a top priority. Worth’s advanced onboarding solution provides the tools needed to streamline compliance processes and ensure thorough due diligence. By leveraging advanced technology, you can onboard new clients quickly and securely, maintaining the highest standards of regulatory compliance.

Experience the future of secure financial onboarding with Worth. Contact us today to learn more about how our advanced onboarding solution can enhance your financial security and streamline your compliance processes.