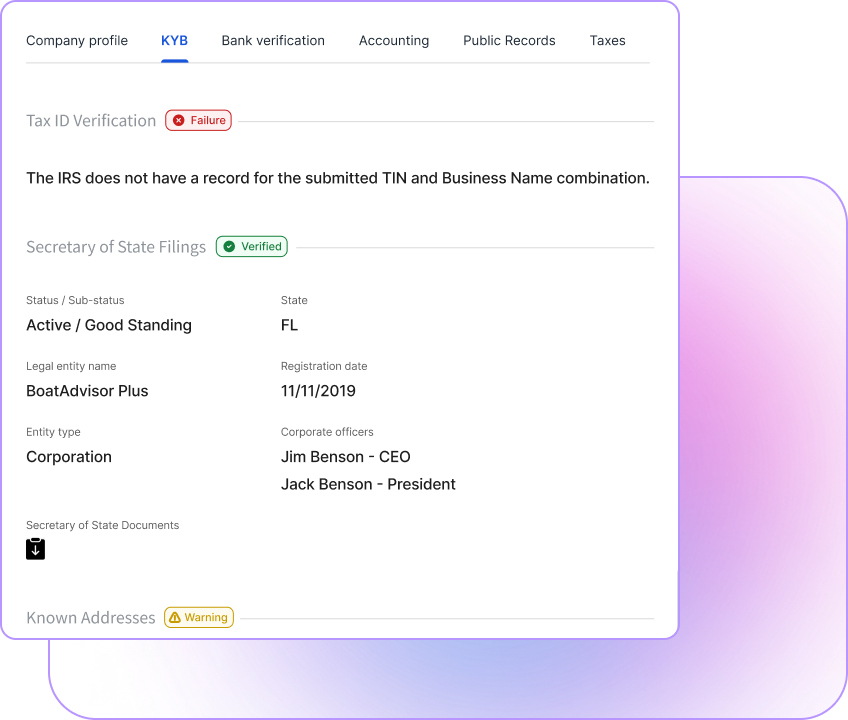

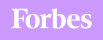

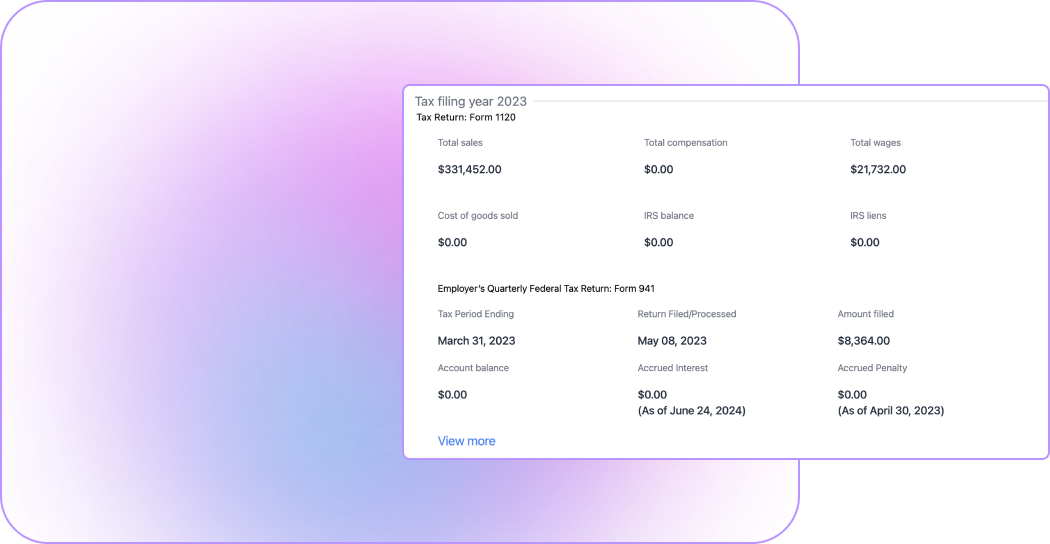

KYB/KYC Checks

- Comprehensive regulatory compliance

- Multi-source data verification

- Enhanced business security

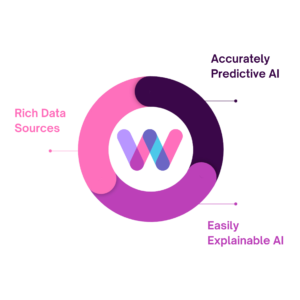

Due Diligence Processes

- Detailed CDD and EDD

- Partner risk assessment

- Regulatory adherence

Identity Verification

- Multi-source verification

- Fraud prevention

- Improved compliance