Welcome to Worth! If you’ve ever found yourself asking, “W.T.F. is Worth?”—don’t worry, you’re not alone. In this blog, we’re breaking down Worth’s Tech Features (W.T.F.) that make us stand out in the financial technology landscape. Let’s dive in and explore what makes Worth the ultimate game-changer for financial institutions.

W.T.F. is Worth?

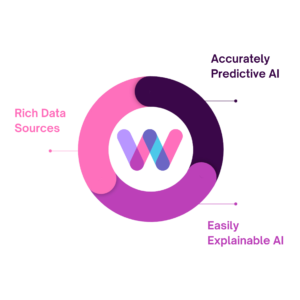

Worth is at the forefront of revolutionizing financial services with our cutting-edge AI-driven solutions. We provide financial institutions with the tools they need to enhance decision-making, streamline operations, and ensure compliance with evolving regulations.

Our mission? To bring clarity, efficiency, and fairness to the financial sector.

The Must-Know Tech Features of Worth AI

AI-Powered Underwriting Assistant – W.T.F. does it do?

Our AI underwriting assistant is like your favorite office buddy—always reliable and never takes a sick day. It streamlines full case management, reduces manual data entry, and provides accurate risk assessments.

Credit Risk Assessment – W.T.F. is it?

Predictive analytics is our crystal ball for financial institutions. It continuously assesses customer portfolios, identifies potential risks before they become problems, and helps you make informed decisions.

Instant Onboarding – W.T.F. is that about?

No more waiting around. Our instant onboarding feature uses AI to quickly verify and onboard new customers, cutting down the process to minutes instead of days. Say goodbye to cumbersome paperwork and hello to efficiency with these key components of our onboarding experience:

- Compliance and Due Diligence: Advance compliance with KYB/KYC, CDD, EDD, identity verification, and watch lists.

- Registration and Verification: Ensure compliance with Secretary of State registration and TIN match verification.

- Reputation and Media Monitoring: Monitor media reputation for comprehensive risk assessment.

Worth Score™ – W.T.F. do I get out of it?

Forget about guesswork! With Worth’s Business Credit Score, you get a real-time, all-encompassing snapshot of your customers’ financial health. This predictive scoring tool combines vast amounts of data to help you see changes and potential risks early on. Not only can you catch operational, credit, and fraud risks before they become problems, but you’ll also get actionable insights on how to manage your customer relationships more effectively. Enhance your financial management, improve customer monitoring, and stay on top of compliance—all with Worth Score™.

Why You Should Care About Worth’s Tech Features

Improved Decision-Making

With AI doing the heavy lifting, you can focus on making strategic decisions based on reliable, data-driven insights. No more guesswork, just smart work.

Enhanced Efficiency

Streamlined processes mean your team can handle more without burning out. Efficiency leads to higher productivity and better customer satisfaction.

Compliance Made Easy

Staying on top of regulations can be daunting, but not with Worth. Our tools ensure you remain compliant with the latest rules, like Section 1071 of the Dodd-Frank Act, without breaking a sweat.

Competitive Edge

In the fast-paced financial world, speed and accuracy are key. Worth’s tech features give you the edge to attract and retain customers by offering the best possible service.

Make it WORTH Your While

Now that you know W.T.F. Worth is all about, it’s time to take the next step. Enhance your financial institution’s capabilities with our innovative AI-driven solutions. Don’t just keep up with the competition—lead the way.

Let’s make financial services smarter, faster, and fairer together. WTF are you waiting for?

Related posts

Access additional resources and insights to support your goals and drive success.

Worth x REPAY: Accelerating Merchant Onboarding & Supplier Verification

When a fintech innovator embraces cutting-edge solutions to streamline process and boost efficiency, the impact can be transformative That’s exactly…

Bridging the Onboarding Gap: Why B2B Needs to Catch Up

Consumerization: Setting the New Standard for B2B Consumerization has reshaped entire industries by elevating customer expectations. The rise of user-friendly…

Experience Seamless Verification: Identify SMBs with the Least Effort

The Challenge of SMB Verification There are about 33.2 million small and medium-sized businesses (SMBs) in the U.S., making up…