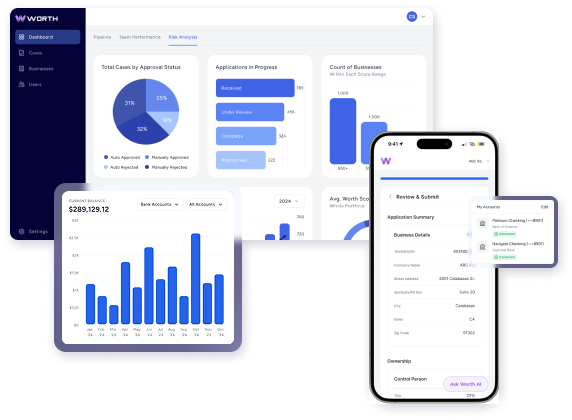

Onboarding &

Underwriting Workflow

Automation Platform

Streamline your operations with platform consolidation for faster approvals,

enhanced compliance, and smarter risk management.

37%+↑

Increase Approval Rates

43%+↓

Reduce Abandonment Rate

242MM+↑

Largest Database of SMBs

Worth’s End-To-End

Product Offerings

Automate key processes, reduce manual effort, and accelerate time-to-revenue with our powerful product suite.

Worth Pre-Fill

Our solution uses AI and direct data integrations to Pre-Fill applications with just three fields (Name, Address, and Tax ID/EIN), drastically reducing manual entry and ensuring high accuracy.

Worth Custom Onboarding

Our customizable Onboarding flow allows you to design mobile- or web-based onboarding processes that capture all necessary customer information in minutes.

Worth Case Management

Streamline your Case Management with customizable workflows, real-time case status updates, and a 360-degree view of your customer's business profile, all in one central location.

Worth Predictive Monitoring

Predictive Risk Monitoring provides real-time insights into customer and portfolio risks, allowing proactive decision-making and mitigation through automated evaluations, timely alerts, and customizable workflows.

Worth Score™

Make better credit decisions with the Worth Score™. This unified score analyzes all data sources, giving you deeper insights and driving growth.

Advanced Features to Accelerate Revenue Growth

Explore Worth Platform's powerful features designed to provide frictionless onboarding with enhanced compliance and automated credit underwriting, in order to streamline faster time to revenue.

Seamless Onboarding

Accelerate onboarding to minutes, optimize customer experience with customized branding and business rules, and ensure high match accuracy to reduce errors and manual intervention.

Learn More

Revenue-Boosting AI

Underwriting

Enhance underwriting processes by prioritizing manual reviews to streamline operations, ensure transparency, minimize bias, and strengthen collaboration between underwriters and risk managers.

Learn MoreUnmatched Data Integration

Achieve unmatched data accuracy with AI/ML-powered matching (Cross-Walking Technology ™) and authoritative data that streamlines application processing, reduces errors, and provides access to a business database of 242 million, twice the size of competitors.

Learn More

Predictive Risk Monitoring

Consolidate tools to save time and costs, boost revenue with predictive monitoring, and streamline risk management by focusing on high-priority alerts.

Learn MoreWorth Score™

Predict Business financial health or failure based on historical data and 1,100+ data points from various sources for smarter risk decisions.

Learn More

Building the Worth Platform

Worth Streamlines onboarding and underwriting by automating KYB, KYC, financial and tax status checks, fraud verification, brand reputation analysis, and more. Our platform leverages a vast database of over 242 million small businesses to generate a predictive business value score, giving you the confidence to make informed risk decisions. This all-in-one solution accelerates time-to-revenue and fosters a fairer financial ecosystem for both enterprises and small businesses.

Cross-Walking Technology

Get the highest and most accurate match rates in the industry from our proprietary, cross-walking technology powered by cutting-edge analytics that seamlessly integrates data from a wide array of data sources, including SoS, IRS and Google.

Worth’s SDK and API Plus White-Labeling

Worth's SDK and API help businesses streamline onboarding by providing developers with tools and code examples for easy integration. With access to Worth's database and scoring features, you can efficiently onboard, assess risk, and manage your portfolio, all while maintaining a consistent, white-labeled experience within your existing workflows.

International Coverage

Worth’s seamless global business solutions provide worldwide coverage, fully compliant with GDPR and all global regulations. Boost your security and trust with detailed international regulatory checks, global ID document verification to prevent fraud, and strengthened crime-prevention policies with up to 99%+ global coverage with Worth’s platform.

Fully Compliant: SOC 2 & GDPR Regulations

Worth is SOC 2 compliant and adheres to rigorous industry standards for data protection, including GDPR, CCPA, and other global regulations. This ensures your data is managed with the highest level of security and privacy.

The Enterprise Solution for

Seamless Customer

Onboarding & Underwriting

Worth is a fintech platform that automates onboarding and underwriting for financial institutions. It uses a massive small business database, workflow automation, KYC/KYB checks, fraud detection, and credit underwriting to help enterprises onboard customers quickly and confidently.

Schedule Demo

What our customers are saying...

Trusted By Leading Enterprises and Partners

Industries We Work With

Our onboarding & underwriting automation workflows are designed with you in mind. At Worth, we’ve built a platform to meet the demands of today’s most dynamic industries.

Streamline Operations,

Maximize Revenue

Consolidate your tools for faster approvals, improved compliance, and smarter risk management.

Schedule Demo