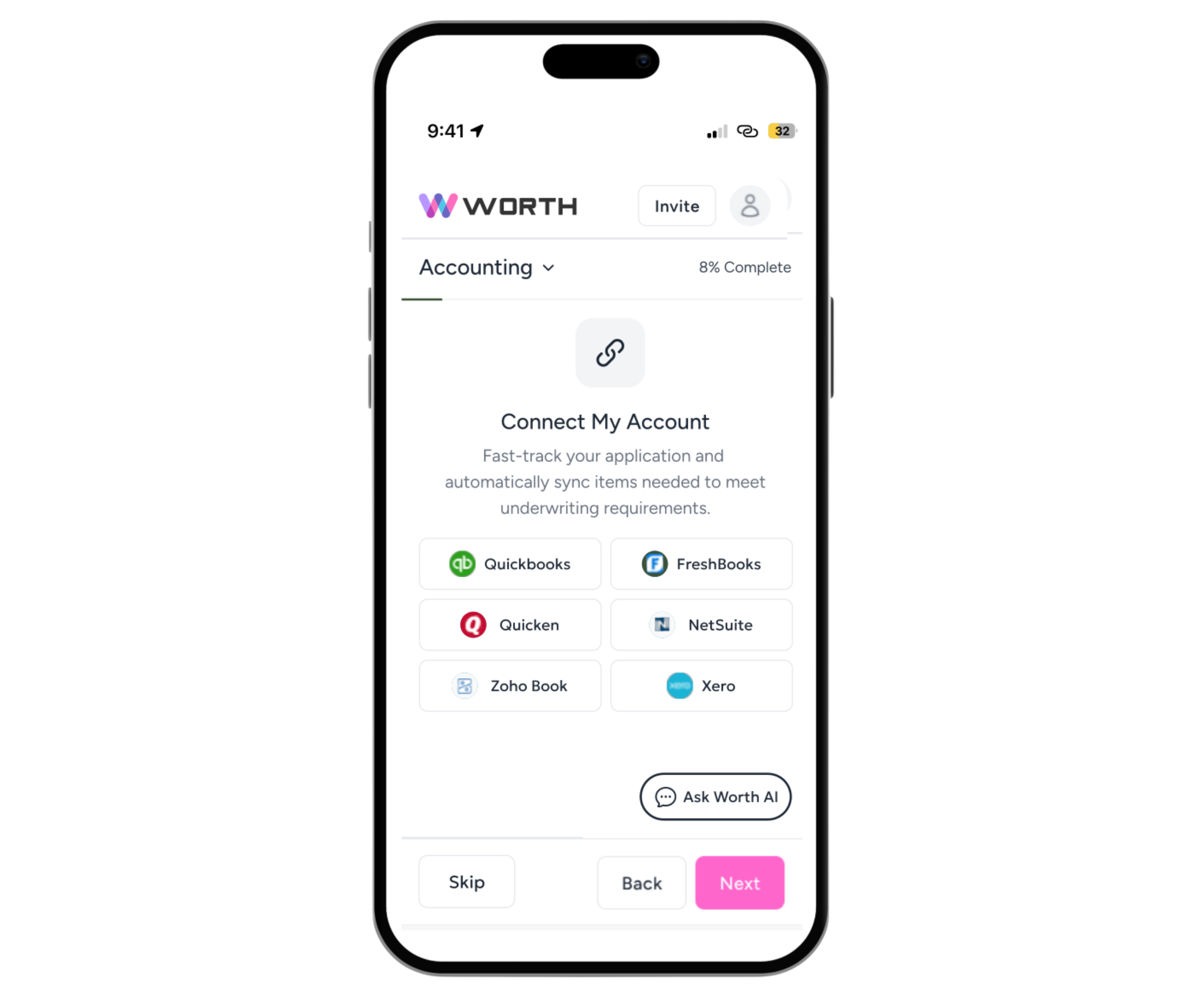

Close Deals Sooner: Accelerated Onboarding

Fed up with seeing potential customers vanish into thin air during your never-ending onboarding process? Worth Pre-Filling technology ignites your customer experience, cutting onboarding time to mere minutes! Reduce application abandonment and accelerate completion rates with automated data population. Faster approvals, quicker activation and boosted revenue growth. Worth’s Zero-Touch Onboarding takes it even further: Just three fields and they’re in! Start collecting more revenue sooner.