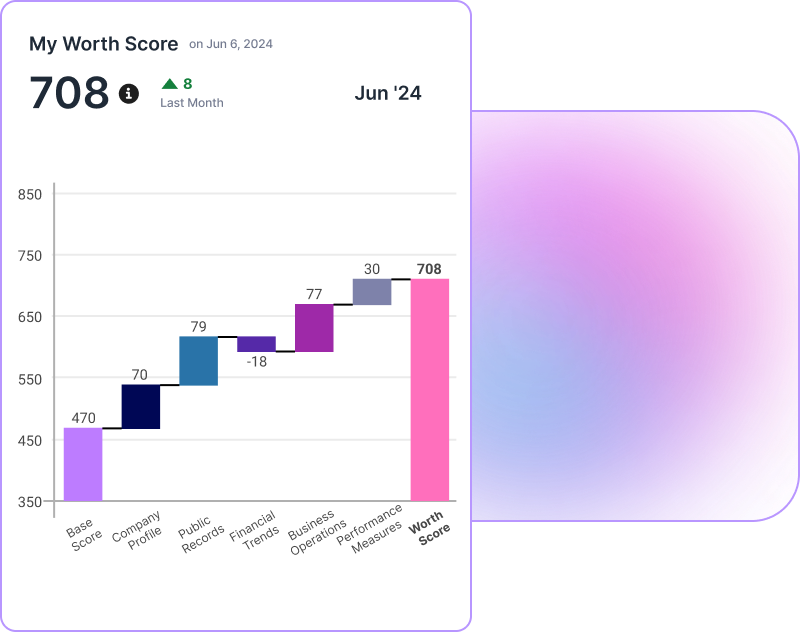

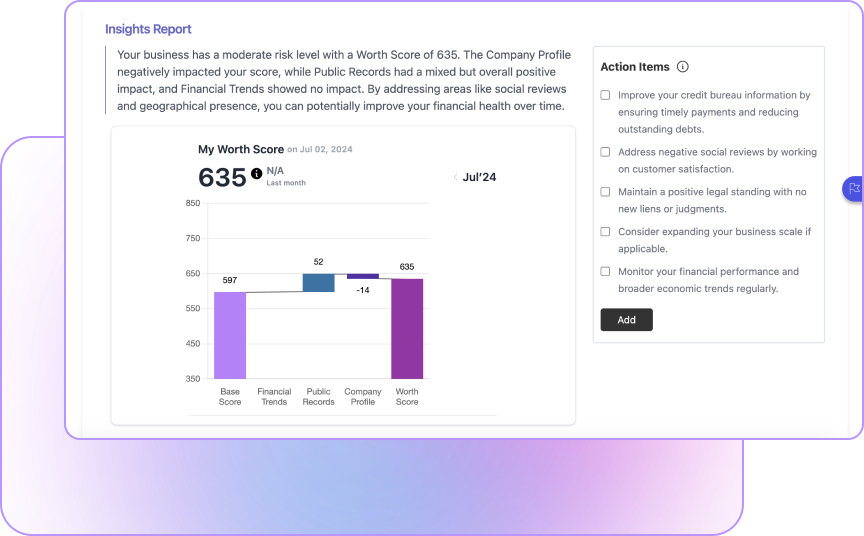

Comprehensive Score

- Multiple metrics integration

- Single unified credit report

- Easy assessment

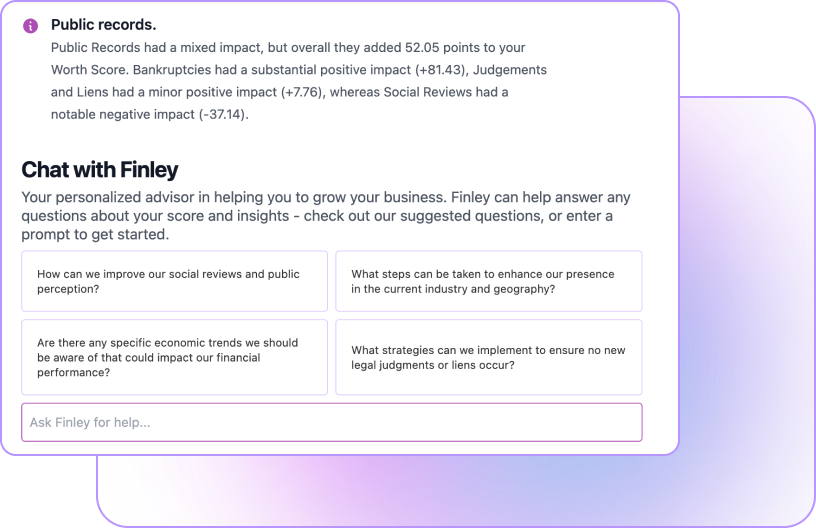

Credit Insights

- Clear creditworthiness view

- Funding assistance

- Trust building

Assessment Tools

- Simplified processes

- Financial standing improvement

- User-friendly interface