Underwriting teams face the ever-present challenge of assessing whether a business presents hidden risk long before it becomes a financial or reputational problem, and adverse media is one of the first signals to look for.

Basic KYB checks, identity verification, and public-record lookups can reveal a business’s structure. Still, they often miss the most dynamic layer of risk: what the world is saying about it.

That’s where adverse media comes in.

Adverse media more simply put, is negative press that indicates the trustworthiness of a business. It offers underwriters a more complete picture of a merchant’s integrity, stability, and market behavior.

Think of it as the business equivalent of a background check: two people may look identical on paper, but their history tells a different story. In the same way, two merchants with similar profiles can present vastly different risk depending on public records, complaints, or unresolved disputes highlighted in news coverage.

Some examples of adverse media coverage include low ratings on major reviewing platforms like Google reviews and Yelp. It also includes any negative press coverage in local news outlets.

Emerging fintech fraud trends show that red flags often surface in public sources before appearing in formal databases.

Adverse media has become a foundational layer of modern underwriting because catching reputational risk early helps prevent costly downstream issues. It strengthens application reviews, improves decision quality, and serves as an early-warning system for risks that aren’t otherwise captured in traditional KYB or financial data.

Pain Points with Traditional Adverse Media Checks

Traditional methods for identifying adverse media rely on scattered searches and manual review. This creates gaps that make it difficult for underwriting teams to spot early warning signs or maintain a consistent approach as application volume grows.

Here are some of the key issues with identifying adverse media using traditional methods:

- Manual searching slows teams down: Underwriters spend too much time reading Google and Yelp reviews and not enough time making judgment calls.

- Critical signals are easy to miss: There is too much noise in local news and niche publications, so it’s difficult to catch and check all of them.

- Decisions become inconsistent: Due to human bias and varying trustworthiness of news sources, different reviewers interpret the same risk information differently.

- High volumes overwhelm workflows: Manual review of negative press doesn’t scale when there are thousands of applicants a month.

- Fraud evolves faster than manual review: Early red flags appear in public sources long before they appear in formal records.

These challenges make it difficult for underwriting teams to stay ahead of risk at scale. When adverse media screening is inconsistent or incomplete, high-risk merchants can pass through onboarding and create costly problems later in the relationship.

The Data, and Why Stronger Screening is Needed

FTC data shows that fraud is increasing 25% year-over-year across financial services and fintech. This trend affects every part of the merchant onboarding process, primarily when teams rely on traditional methods that do not capture early reputational signals. As risk becomes more complex, adverse media becomes an increasingly important layer for identifying merchants who may cause problems later.

Recent studies help illustrate this shift.

- One report found that financial institutions in the United States experienced a 65% increase in fraud losses in a single year.

- A global forecast projects that fraud will cost financial institutions more than $58 billion by the end of the decade.

- Another report shows that merchants worldwide are expected to lose more than $362 billion to online payment fraud between 2023 and 2028.

Many of these losses begin with early warning signs that appear in public sources long before they show up in formal databases. News articles, consumer complaints, regional reporting, and industry publications often contain the first indicators of risky behavior. When underwriting relies only on basic KYB checks and manual searches, these signals are frequently missed.

This creates a growing need for automated tools that can scan a wide range of sources, interpret the information, and highlight potential risk before it enters the underwriting pipeline.

Stronger screening is not only a compliance requirement. It’s also a way for organizations to prevent avoidable losses and build a more resilient onboarding process.

How Worth Solves These Challenges

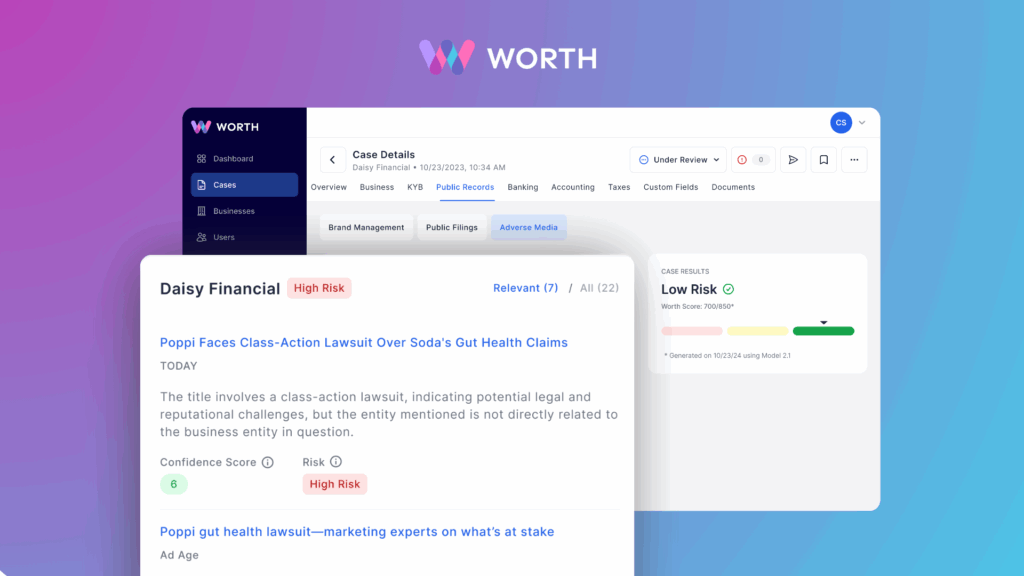

Worth approaches adverse media screening through automation, enriched data, and a unified workflow that removes the friction of traditional methods. Instead of relying on manual searching, the platform brings all relevant signals together in one place and evaluates them through a consistent, repeatable process.

Key benefits of Worth’s Adverse Media Engine

- Scans trusted and diverse sources: The engine reviews news outlets, regulatory sites like Yelp and Google reviews, local publications, industry databases, and consumer forums to create a complete view of a merchant.

- Connects media to the right business: By integrating multiple first- and third-party authoritative data sources, Worth ensures that negative press is linked to the correct business entity, even when names appear in different formats.

- Turns information into risk signals: The system analyzes media patterns and produces a clear, structured signal that is easier for underwriters to act on.

- Built for high-volume onboarding: Media patterns are converted into clear, actionable indicators, so high-volume teams can process more applications without sacrificing review quality.

- Always on monitoring: The engine continues to review public sources after onboarding. New information triggers updated alerts that help teams stay proactive.

- Automated and consistent: Underwriters do not need to interpret every article. The platform applies the same logic to every merchant, resulting in better decision-making and a stronger audit trail.

These capabilities give underwriting and operations teams a more reliable way to identify risk early in the onboarding lifecycle. Worth transforms adverse media from a manual and inconsistent task into a streamlined part of the decision process.

The Worth Advantage

Adverse media is one of the most reliable early signals of merchant risk, yet it is often missed when teams rely on manual searching or basic KYB checks. Worth makes this process easier by bringing trusted sources, clear risk signals, and automated monitoring into a single workflow. Underwriters gain faster and more consistent decisions, and operations teams can scale without losing visibility into potential issues.

With stronger screening in place, organizations can reduce fraud exposure, improve portfolio quality, and create a smoother path from application to approval.

To take a closer look at how Worth’s Adverse Media engine strengthens the onboarding process, schedule a demo with our team.

Related posts

Access additional resources and insights to support your goals and drive success.

Why Customers Choose Worth for Faster, Smarter Underwriting

Worth helps teams onboard businesses faster, reduce risk, and scale underwriting without adding operational friction. See why fintechs, ISVs, and…

Clone Cases with Speed: Accelerate Time to Revenue with Underwriting Automation

What if underwriting workflows scaled the same way businesses do? Clone Cases reimagines case management by creating a repeatable system…

A Lookahead at Worth in 2026

As we wrap up 2025, the Worth team is already looking ahead to an ambitious year of travel, connection, and…