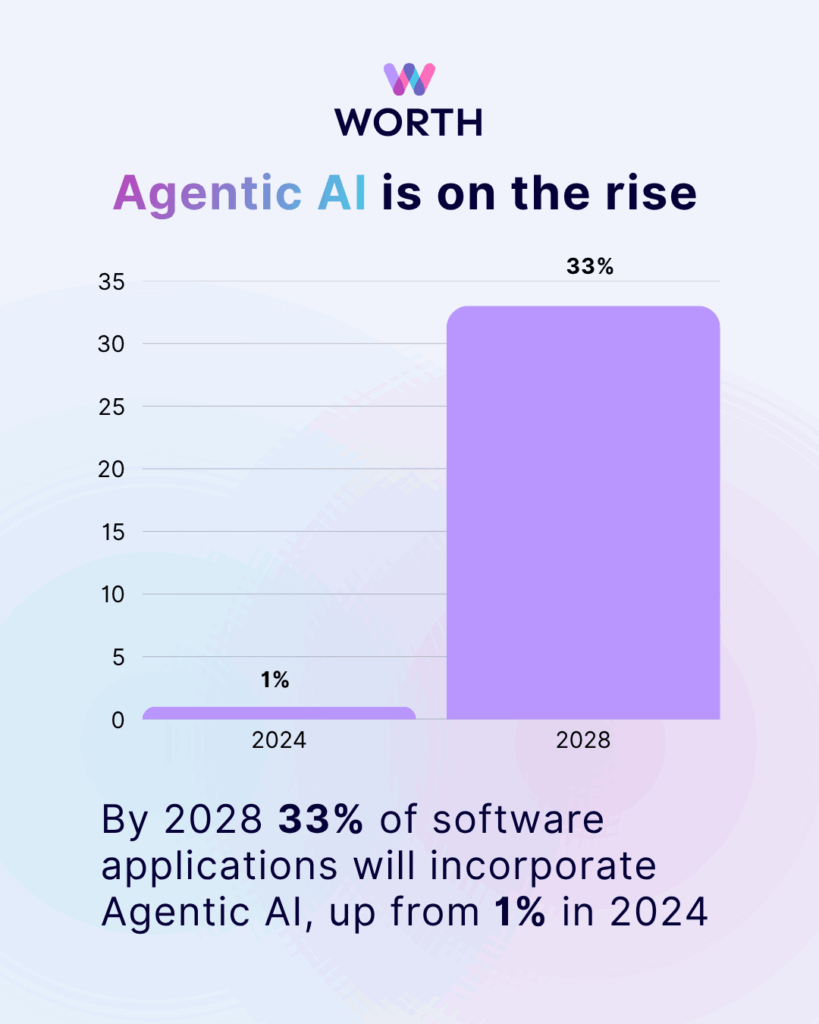

If 2023 was the year of chatbots, 2025 is shaping up to be the year of Agentic AI.

But what the heck even is Agentic AI?

At its core, Agentic AI is the next evolution of artificial intelligence. These are systems that do more than respond to commands. They plan tasks, make decisions, and take initiative toward goals with minimal human oversight. Think of them as digital coworkers that can reason, delegate, and adapt as conditions change.

Since the dawn of computing, automation has handled repetitive tasks. Today, Agentic AI is handling complexity, messy data, and constantly changing priorities.

To put the scale in perspective: the global Agentic AI market is expected to grow from about $5 billion in 2024 to nearly $200 billion by 2034, an annual growth rate of roughly 43%.

These systems are already showing up in underwriting, customer onboarding, fraud prevention, and compliance across fintech, and they’re moving the industry from rigid decision trees to living systems that can react in real time.

Growth & Adoption of Agentic AI in Finance and Fintech

Agentic AI is going from concept to reality faster than most emerging technologies. Financial institutions and fintechs are already investing heavily in systems that can think, learn, and act with minimal supervision.

Recent data shows the pace of adoption is accelerating. According to an article at The Financial Brand, a survey found 70% of banking institutions are using agentic AI in either production or pilot stages.

The financial sector is no longer asking whether AI agents can add value. Now, they’re focusing on how fast agents can be deployed and how securely they can operate.

This growth is being driven by three key forces:

- Data complexity. Financial data is expanding in both volume and variety, creating opportunities for systems that can process it faster and with greater accuracy.

- Operational efficiency. Institutions are under pressure to do more with the same headcount. Agentic AI can automate repetitive, data-heavy tasks and free human experts for strategic work.

- Customer expectations. Consumers and businesses now expect instant credit decisions, real-time verification, and personalized experiences. Agentic AI helps make those expectations realistic.

Agentic AI is not a futuristic idea waiting around for regulation to take effect. It is already starting to reshape how fintechs process information, evaluate risk, and make decisions in milliseconds.

Underwriting in Fintech

Onboarding and underwriting have always been a core part of finance and fintech. Through underwriting, risk is assessed, decisions are made, and growth becomes possible. In the age of AI, underwriters face more pressure than ever. Companies must make decisions even faster, handle more data, and maintain strict compliance with constantly evolving regulations.

So what are the main challenges of underwriting?

Fintech underwriters face data fragmentation across multiple sources, such as bank transactions, business signals, credit reports, and alternative data. Bringing all of it together into one clear view is time-consuming and complex.

Many workflows remain manual or semi-automated, which means underwriters spend valuable time collecting documents, verifying information, and routing cases instead of focusing on high-value judgment calls.

Regulatory creep in areas such as KYC, KYB, and AML has grown increasingly detailed. Errors can be costly both financially and reputationally.

Scaling throughput without continually adding new team members is one of the biggest hurdles for modern fintechs.

Why Agentic AI changes everything

Agentic AI introduces a new model for underwriting, bringing human underwriters into the process for more mission-critical decision-making.

There are a number of practical applications for what Agentic AI looks like in action:

Data Intake: An AI agent can automatically populate and enrich application data by pulling from APIs and business databases, flag missing information, and route each case to the right person or queue. Worth Pre-Fill is a great example of this.

Risk scoring and decision support: Instead of relying on static rule sets, Agentic AI can analyze multiple data sources in real time and generate risk scores that adapt as new data becomes available. Worth Score™ offers customizability to fit the requirements of most institutions.

Continuous monitoring: Underwriting does not end with a single decision. Agentic AI can monitor behavior and transaction patterns over time and alert teams when a new review is needed. Worth offers comprehensive predictive monitoring so teams can rest easy knowing that there are “always-on” systems tracking merchants.

Worth’s own customers have already seen the results. By implementing the Worth Platform, PatientFi reduced underwriting time by 50% without increasing headcount. The platform automated data collection and verification, freeing underwriters for higher-value tasks like complex analysis and better outcomes for customers.

Risks, Data & Governance to Watch

Agentic AI can unlock enormous potential for fintech underwriting, but it also introduces new layers of responsibility. As companies automate more and more of the decision-making, the risks around data, privacy, and control become just as important as the benefits.

Underwriting involves some of the most sensitive data in finance. Bank statements, identification documents, and business financials all pass through these systems, creating a large surface area for potential breaches. Fintech companies that deploy Agentic AI must integrate security into every layer of their technology. If an AI agent has excessive permissions, it can quickly become an entry point for attackers. The University of Sydney highlights the dangers of operating in Agent Mode when using OpenAI’s new Atlas browser

Explainability is just as important. Every underwriting decision must be transparent to both regulators and customers. As Agentic AI systems become increasingly complex, the risk of bias also increases. Compliance teams need to be involved from the very beginning to establish parameters before automation scales.

Ultimately, the goal is not to replace humans, but to support them. Underwriters and risk managers should always have clear visibility into how an AI system reaches its conclusions. When you pair Agentic AI with strong governance, together, they create systems that are both efficient and responsible. The organizations that find a way to strike this balance will set the standard for safe and scalable AI underwriting in the years ahead.

Next Steps If You’re a Fintech Underwriting Leader

For leaders, the question is how to introduce this technology responsibly and effectively. A thoughtful rollout can multiply efficiency without sacrificing oversight or customer trust.

The first step is to map your current workflow. Identify where underwriters spend the most time on manual or repetitive work, such as data collection, document review, or case routing. These areas often deliver the fastest return when automated.

Next, start small and scale strategically. Pilot a single use case, such as AI-assisted intake or document verification, before extending it across your entire underwriting process. Measured implementation builds internal confidence and gives your compliance and data teams time to refine controls.

Strong data foundations are essential. Clean, well-structured data allows Agentic AI to operate with precision and reliability. Companies that invest early in data quality, secure API connections, and consistent record keeping see faster gains once automation begins.

The most successful institutions treat Agentic AI as part of a human-centered strategy. Underwriters remain decision makers, while AI agents act as assistants that handle routine tasks and surface insights. Regular performance monitoring, fairness reviews, and compliance audits help maintain trust across teams and with regulators.

Finally, choose technology partners that align with your goals and governance standards. Platforms like Worth are designed to help banks, credit unions, and fintechs implement artificial intelligence safely, combining speed and scalability with transparency and control. The goal is not just faster underwriting but better underwriting.

Conclusion

Agentic AI is transforming how fintechs approach underwriting. It brings new levels of speed, precision, and scalability while keeping humans at the center of every decision. The future is not a decision that needs to be made between using humans or agents. Companies need to use both, working hand-in-hand to make smarter, faster, and more trustworthy financial decisions.

Want to see how Worth is using AI to bring underwriting to the 21st century? Schedule a demo to see our solution in action.

Related posts

Access additional resources and insights to support your goals and drive success.

Why Customers Choose Worth for Faster, Smarter Underwriting

Worth helps teams onboard businesses faster, reduce risk, and scale underwriting without adding operational friction. See why fintechs, ISVs, and…

Clone Cases with Speed: Accelerate Time to Revenue with Underwriting Automation

What if underwriting workflows scaled the same way businesses do? Clone Cases reimagines case management by creating a repeatable system…

A Lookahead at Worth in 2026

As we wrap up 2025, the Worth team is already looking ahead to an ambitious year of travel, connection, and…