AI-Enhanced

- Streamlined processes

- Accurate evaluations

- Reduced workload

Efficiency Boost

- Automated tools

- Process enhancement

- Time-saving

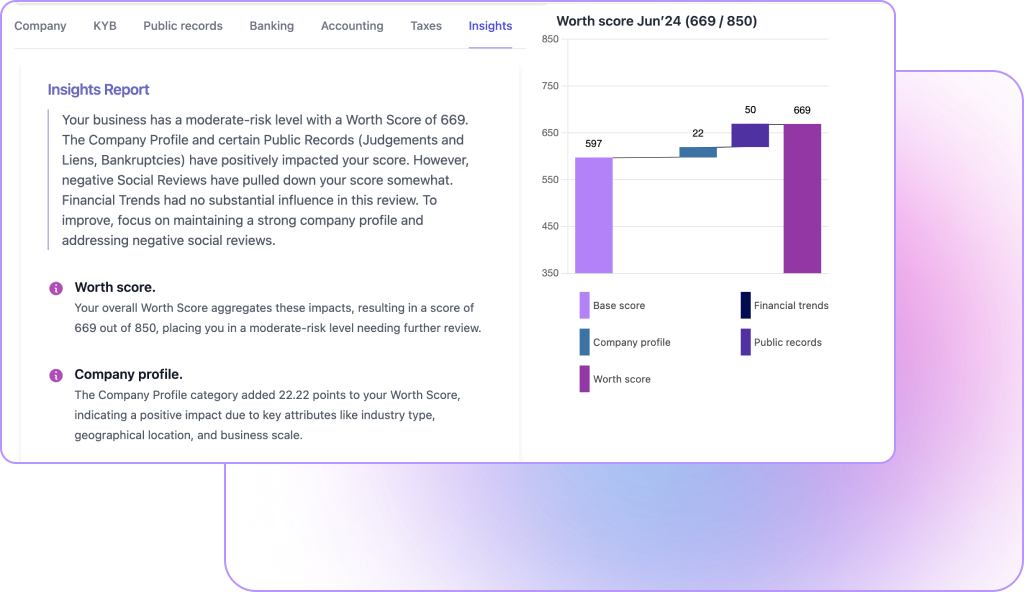

AI-Powered Analysis

- Instantly uncover risk signals

- Assess current and long-term risks

- Comprehensive risk evaluation

360-Degree Business View

- Analyze over 1,100 data points

- Total view of business health

- Unique brand reputation insights

Unique Data Sources

- Access data competitors lack

- Enhance underwriting precision

- Comprehensive business profile