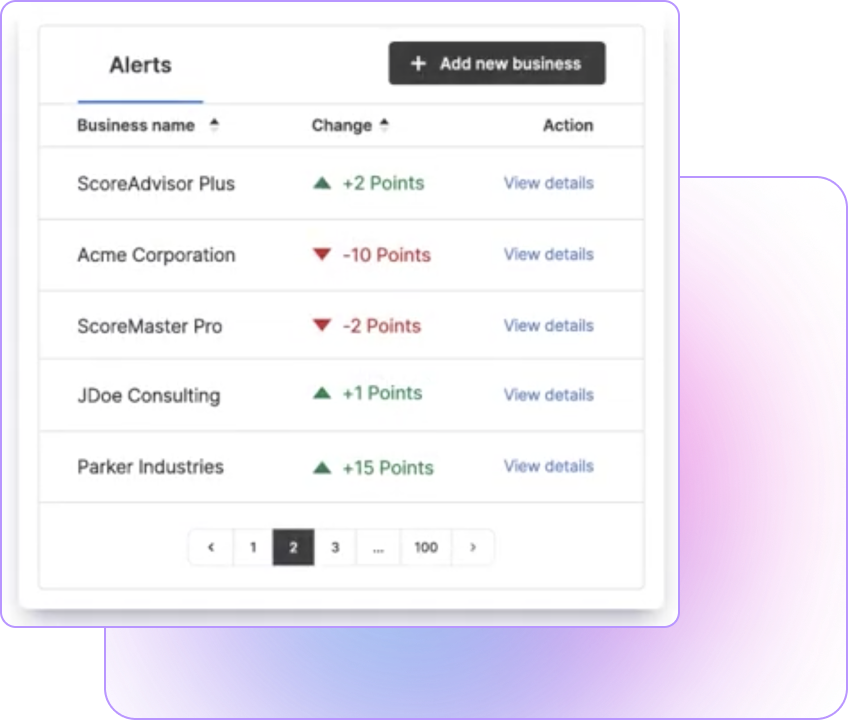

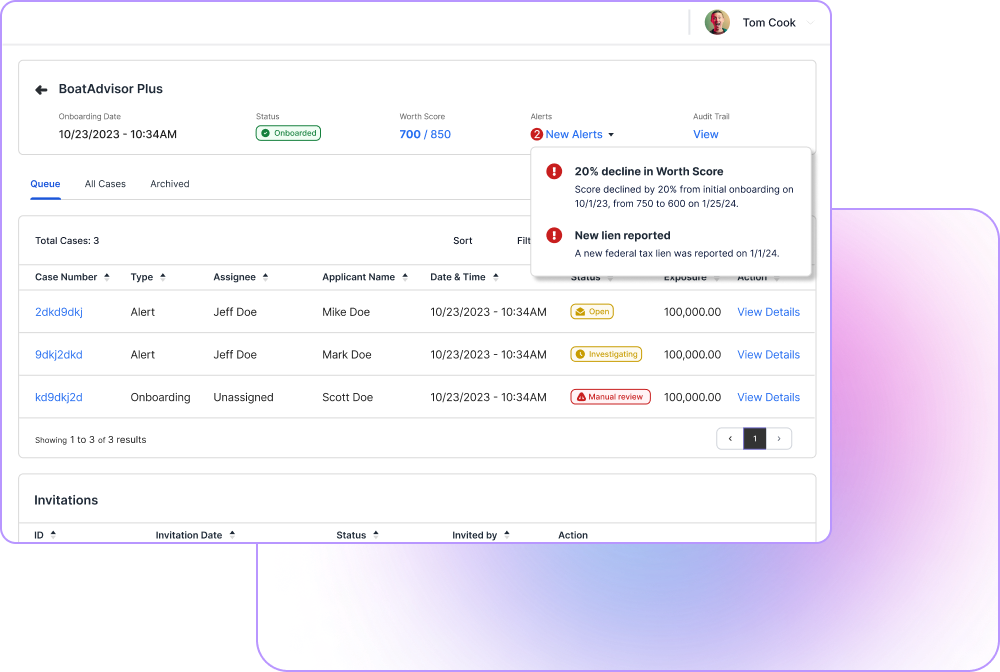

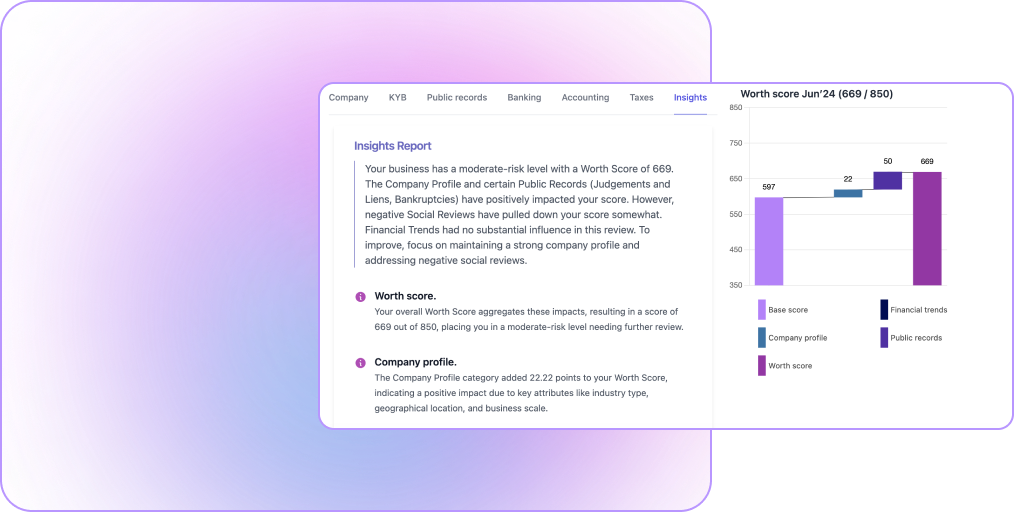

Real-Time Underwriting Insights

- Instant insights

- Decision enhancement

- Proactive assistance

Complex Decision Support

- Accurate recommendations

- AI-driven support

- Informed choices

Efficiency and Task Automation

- Reduced manual tasks

- Instant information

- Process improvement