Financial leaders are entering a period where growth is defined by operational speed and the ability to eliminate internal friction.

Multi-location businesses are built to scale. Most underwriting workflows aren’t.

In the real world, growth is constant. New locations. New entities. New DBAs. The business evolves, but the foundation often stays the same.

Same ownership.

Same operators.

Same business model.

Similar financial behavior.

Similar risk posture.

Yet most underwriting teams are forced to treat every new location as if it were day one. They re-collect information they already have. They repeat reviews that don’t produce a new signal. They rebuild cases from scratch when the core risk context hasn’t materially changed.

This creates a fundamental mismatch between how modern businesses grow and how underwriting is executed. Instead of enabling expansion, the process slows it down. Instead of building on institutional knowledge, it ignores it.

At small volumes, this friction is tolerable, but every duplicated step adds time and delays activation, pushing revenue further out, even when the underlying risk hasn’t materially changed. At scale, friction isn’t just a minor inconvenience. It’s a tax on growth.

The Hidden Cost of Starting Over

Traditional underwriting workflows are built around the idea that every case is unique. That assumption drives teams to re-collect the same information, re-run the same checks, and re-document the same rationale.

For multi-location organizations, this creates compounding drag. Each new location adds operational load, and underwriters spend time revalidating what’s already known. Instead of building on prior decisions, teams are forced to recreate them. Instead of extending institutional knowledge, they reset it.

So what does that mean for underwriters?

Redundant data collection. Repeated reviews of unchanged information. Manual rework that adds no new signal. Longer approval cycles. Slower onboarding. Delayed revenue.

Over time, it leads to inconsistency. Two locations with the same ownership and risk profile may receive different outcomes simply because the process treated them as unrelated. That inconsistency is dangerous. It undermines confidence in the process and makes it harder to explain decisions internally, to regulators, or to auditors. What should be a controlled, repeatable system becomes fragmented and harder to manage as volume increases.

Clone Cases: Start Where the Signal Already Exists

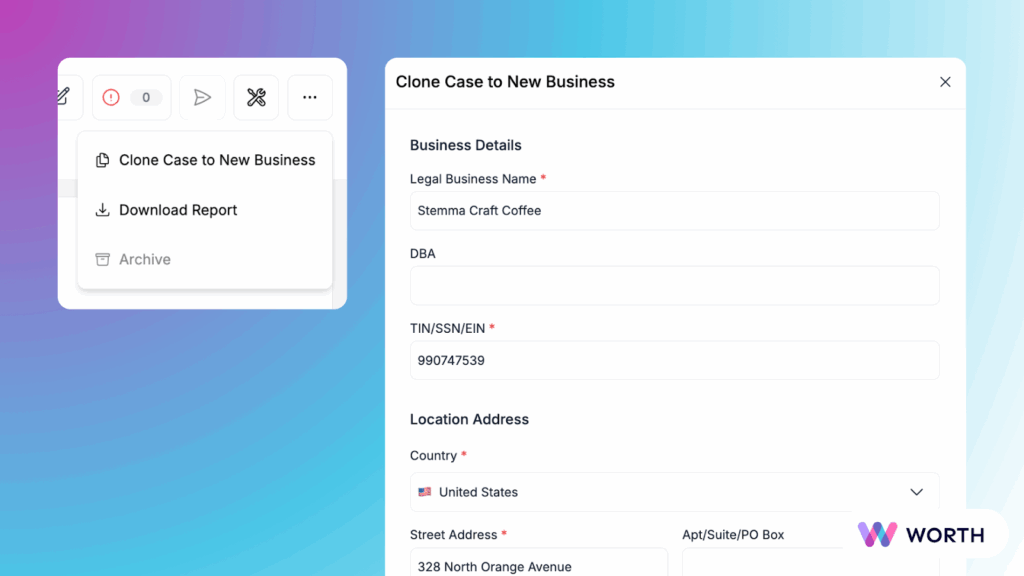

The Worth platform enables powerful underwriting automation, so teams can clone an existing case to a new business or location.

The ability to clone cases changes the underwriting starting point. Instead of rebuilding a case from scratch for every new business or location, teams can clone an existing underwriting case and use it as the foundation for the next one. The core risk context, like ownership, operating structure, and historical rationale, carries forward with a complete audit trail.

At the same time, underwriters stay in control. Critical elements like banking information are intentionally re-linked, and only what’s different gets reviewed.

The Clone Cases feature is designed for real operating models:

- Franchises

- Multi-location merchants

- Parent-child entities

- Expansion-driven portfolios

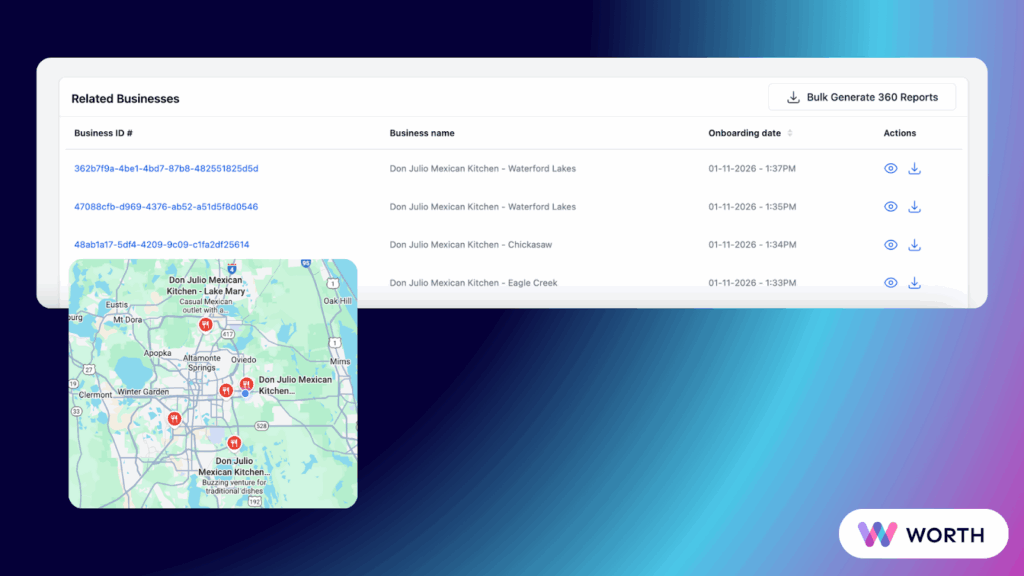

The foundation stays consistent, and each new entity gets what it needs. Each location is linked to the others, fully traceable under Related Businesses.

This isn’t just an underwriting automation tool for speed’s sake (though it does accelerate time-to-revenue). It’s about anchoring new decisions in an established context and moving forward with confidence.

Accelerated Decisions, Accelerated Time to Revenue

The impact shows up immediately. Decision cycles shorten. Onboarding moves faster. New locations activate sooner. Revenue comes online earlier, without waiting for manual underwriting or siloed, disjoined tools to catch up to the business.

While time savings matter, momentum matters more. Underwriters spend less time recreating decisions and more time exercising judgment where it counts. By turning proven underwriting decisions into a repeatable system, teams move faster without compromising control.

Ready to accelerate time to revenue?

Clone Cases turns existing underwriting decisions into a repeatable system designed for business growth.

See the Worth platform in action → Book a demo today.

Related posts

Access additional resources and insights to support your goals and drive success.

Why Customers Choose Worth for Faster, Smarter Underwriting

Worth helps teams onboard businesses faster, reduce risk, and scale underwriting without adding operational friction. See why fintechs, ISVs, and…

A Lookahead at Worth in 2026

As we wrap up 2025, the Worth team is already looking ahead to an ambitious year of travel, connection, and…

Why Adverse Media Is a Critical Layer in Your Underwriting Stack

Underwriting teams face the ever-present challenge of assessing whether a business presents hidden risk long before it becomes a financial…