Company Overview

- A publicly-traded payment processor

- Approximately 5,000 net new business applicants monthly

- Average annual revenue of $9,800 per customer

- 5 different go-to-market motions (direct, channel, digital, partnerships, acquisitions)

- Operating in 10+ countries

- Fragmented technology stack through multiple acquisitions and inherited legacy solutions

Key Challenges

The company’s growth introduced complexities in maintaining compliance while meeting customer expectations. Specific challenges included:

- Applications Abandoned and Rejected: Approximately 2,000 applications abandoned and rejected each month due to confusing and cumbersome processes, resulting in lost revenue opportunities.

- Onboarding Inefficiencies: The onboarding process required 76 data fields, leading to delays and a high customer abandonment rate.

- Operational Bottlenecks: Manual processes such as document uploads, compliance scoring, and audits placed excessive strain on teams, limiting the company’s ability to scale efficiently.

- Incomplete Datasets: 68% KYB match rates leading to rejections on otherwise good businesses.

- Lack of Cohesive Digital Experience: Current process consisted of webforms, fax, and digital e-signatures.

These challenges translated into missed revenue opportunities and growing operational costs, making it clear that a revamped experience was necessary.

Partnership with Worth

The company collaborated with Worth to address these challenges by implementing a streamlined, automated solution focused on:

Reduced Application Abandonment and Rejection Rate:

- Onboarding Optimization: Simplifying the onboarding process through autofill technology, reducing data field requirements from 76 down to 9 required fields.

- Workflow & Onboarding Automation: Pre-transaction KYB (Know Your Business) and KYC (Know Your Customer) checks accelerated approval processes while maintaining adherence to regulations.

- Largest SMB Dataset with the Highest Match Rate: Leveraging Worth Score™ for informed decision-making to balance growth and portfolio risk.

- Modern Digital Experience: Automating repetitive tasks to free up teams for higher-value activities and strategic initiatives.

Results and Metrics

The integration of Worth’s platform yielded measurable improvements across key performance areas:

Revenue Growth

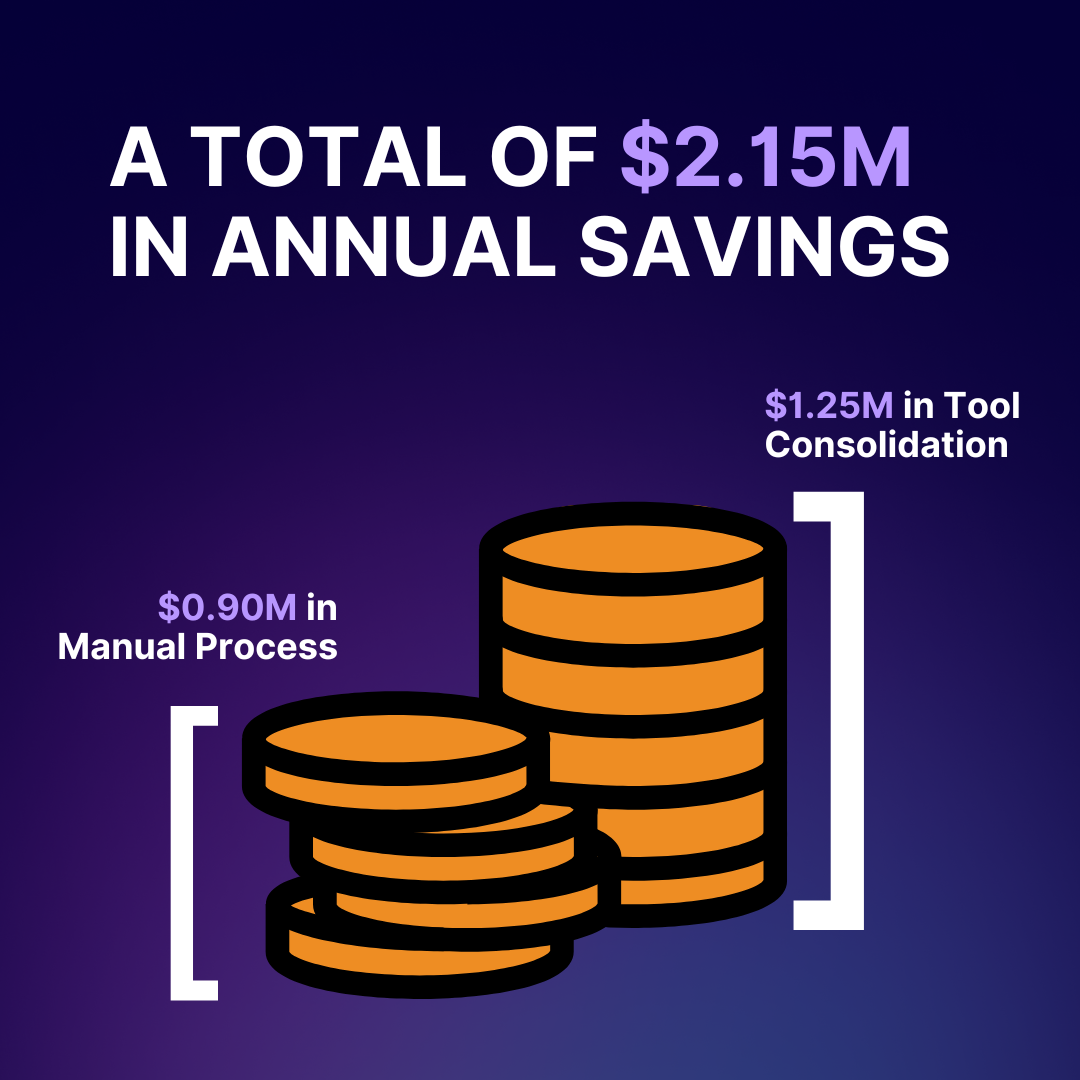

Cost Reduction

Customer Retention & Value

- Customer Lifetime Value (CLV): Increased by over $84.75M due to improved onboarding speed and satisfaction.

Operational Improvements

- Onboarding Time: Reduced from 17 days to 7 days, allowing faster revenue generation.

- Abandonment Rate: Decreased by 35%, recovering previously lost revenue.

Internal and Customer Impact

Employee Benefits:

- Reduced manual workloads: Allowed teams to focus on high-value projects.

- Real-time analytics: Provided leadership with actionable insights for data-driven decision-making.

Customer Benefits:

- Streamlined onboarding: Improved user experience and satisfaction.

- Faster activation times: Increased customer trust and retention.

Compliance and Risk Management

Worth’s solution ensured strict adherence to regulatory requirements without compromising customer experience. Automated checks for KYB and KYC compliance provided a scalable framework to support growth.

Testimonials

CEO’s Perspective

"Worth’s platform enabled us to unlock hidden revenue potential while streamlining operations. Their solution positions us as a leader in both compliance and customer experience."

Chief Risk & Underwriting Officer’s Perspective

"The automation and insights from Worth have transformed how we manage compliance and risk. What was once a bottleneck is now a competitive advantage."

Conclusion

Within the first year of implementation, the company realized:

- New Revenue: $9.36M annually

- Cost Savings: $2.15M annually

Worth’s comprehensive platform enabled this payment processor to scale effectively, enhance customer satisfaction, and maintain compliance, securing its position as a market leader.

Related posts

Access additional resources and insights to support your goals and drive success.

No related posts found.