What is Section 1071?

In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced Section 1071, aiming to promote fairness and transparency in small business lending. This section mandates financial institutions to collect and report detailed data on credit applications from small businesses, including information about the business and its principal owners. The goal is to identify and address discriminatory lending practices, thereby promoting equitable access to credit for minority-owned small businesses.

How Can My Institution Comply?

- Meet Data Collection Requirements: Financial institutions must collect information such as the type and purpose of the credit, amount requested, business demographics, and the ethnicity, race, and sex of the principal owners.

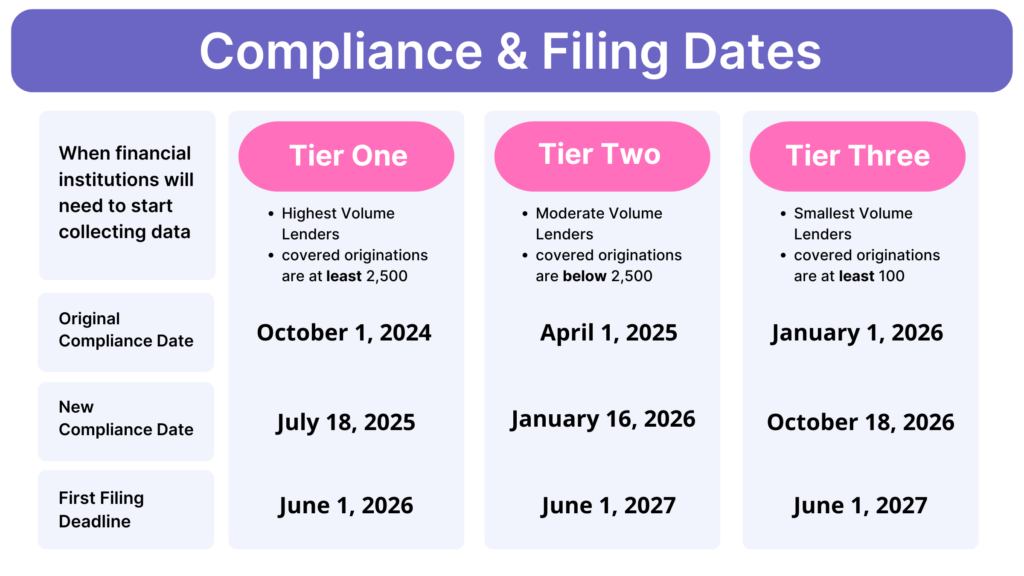

- Keep Track of Compliance Dates: Initially issued on March 30, 2023, with staggered compliance deadlines, extending into 2026 for different tiers of institutions.

- Practice Regulatory Compliance: Institutions must ensure accurate data collection and reporting while safeguarding the privacy of the applicants.

What Kind of Data Will My Institution Collect?

Section 1071 mandates financial institutions to collect and report specific data points on small business lending. These data points include:

- The number of applications for credit.

- The number of loans made.

- The amount of credit applied for and granted.

- The type and purpose of the loan.

- Demographic information of the principal owners, including race, sex, and ethnicity.

- The location of the business.

These provisions are designed to help identify potential discriminatory lending practices and to promote transparency and accountability in the financial sector.

When Will Section 1071 Be Implemented?

How Worth Can Help My Institution Prepare: Worth offers comprehensive AI-powered solutions to streamline data collection and compliance for like Dodd-Frank

- Automated Data Collection: Automatically uphold KYC (Know Your Customer) and KYB (Know Your Business) compliance regulations through our streamlined onboarding process while offering equal, unbiased opportunity for all potential credit union members.

- Compliance Monitoring: Our Underwriting AI continuously reviews data, flagging and autonomously pulling key information to build out a more complete business profile. Real-time monitoring tools help institutions stay up-to-date and compliant by automatically requesting additional information from the customer if needed.

- Portfolio Audit Review: With the Worth Platform you have the ability to review your entire portfolio in seconds. Find out your overall health, (Insert things that are required and show them KPIs that they would get)

By leveraging Worth’s technology, financial institutions can enhance their compliance efforts, reduce administrative burdens, and promote fair lending practices.

Schedule a call to learn how Worth can help today.

Related posts

Access additional resources and insights to support your goals and drive success.

One Year Later: Building the Future of SMB Onboarding & Underwriting

Reflecting on Year One When we launched Worth, our mission was simple: build a more equitable financial ecosystem, one where…

Five Things Fintechs Can Do To Win In The Identity-Driven SMB Era

This article was originally published on Forbes through the Young Entrepreneur Council (YEC), where Sal Rehmetullah shares insights as a…

Upgrade Your SMB Onboarding: Pre-Fill Your Way to Faster Approvals and Higher Conversions

Paper applications are the worst. They leave room for error, they’re slow and they’re a guaranteed way to lose high-value…