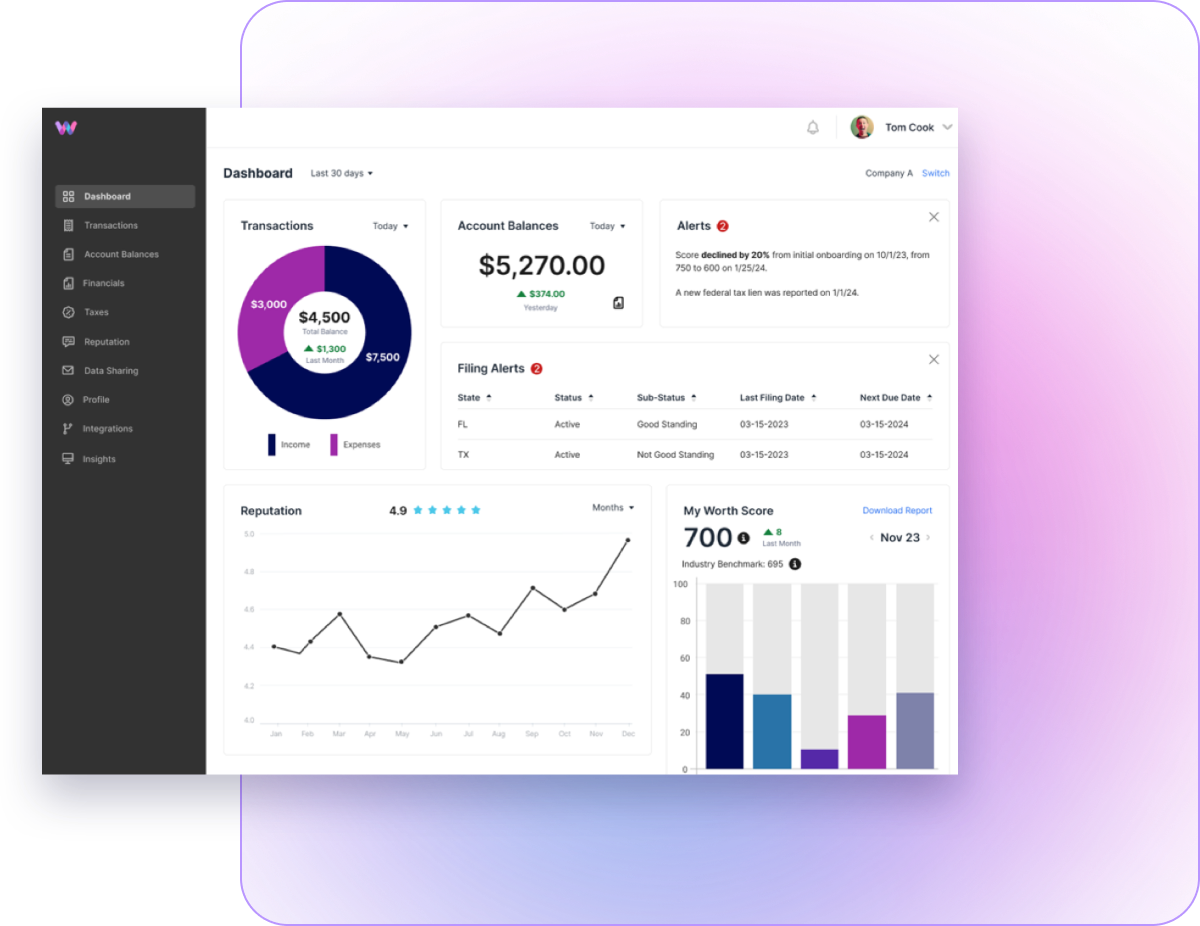

Automated Risk Evaluation

Enhance your credit risk assessments with automation and continuous monitoring.

The Most Comprehensive

Compliance Solution

Compliance and Due Diligence

Ensure scalable KYB Compliance Effortlessly meet KYB requirements at scale. Automatically screen against watchlists and verify essential business details, including name, address, TIN, and associated individuals, ensuring you confidently know you business customers.

Registration and Verification

Access detailed business attributes to mitigate legal and financial risks. Satisfy CIP, CDD, and EDD requirements with a complete picture of your business customers.

Reputation and Media Monitoring

Enhance the onboarding experience by reducing friction and boosting auto-approvals rates. Leverage our reliable and transparent data sources, covering 100% of registered businesses in the US, to onboard with confidence.

The Only Credit Score for Every Business

Confidently accelerate decisions and eliminate the complexity of underwriting risk management by leveraging all the power of AI.